Biotech companies have always been vital to the healthcare and pharmaceutical industries, driving innovations that can lead to groundbreaking treatments and cures. Singapore; ranked sixth best in the world for healthcare by the WHO (World Health Organisation), has been at the forefront in medical research, which houses 8 of the top 10 pharmaceutical companies in the world.

As we enter 2024, a noticeable trend is the increasing number of biotech firms pursuing Initial Public Offerings (IPOs). According to BioPharma Drive, nine biotech companies have collectively raised $USD 1.3 billion from IPOs, up from just $USD375 million in the first quarter of 2023.

Why More Biotech Are Going IPO?

Several factors fuel this movement, ranging from market dynamics to advancements in biotechnology. Here are five key reasons why biotech companies are pushing for IPOs in 2024:

1. Favorable Market Conditions

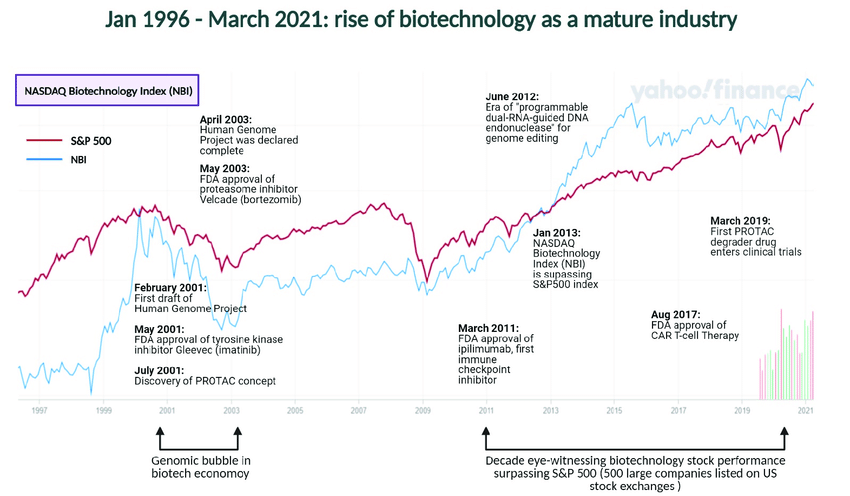

The Nasdaq Biotechnology Index (NBI), which is often used as a benchmark for the sector, has seen a steady increase. As of early 2024, the NBI has grown by approximately 15% over the past year, reflecting investor confidence in biotech innovations and their potential profitability.

This uptick is partly due to increased public and investor interest in healthcare advancements spurred by the COVID-19 pandemic, highlighting biotechnology's critical importance.

2. Advancements in Biotech Innovations

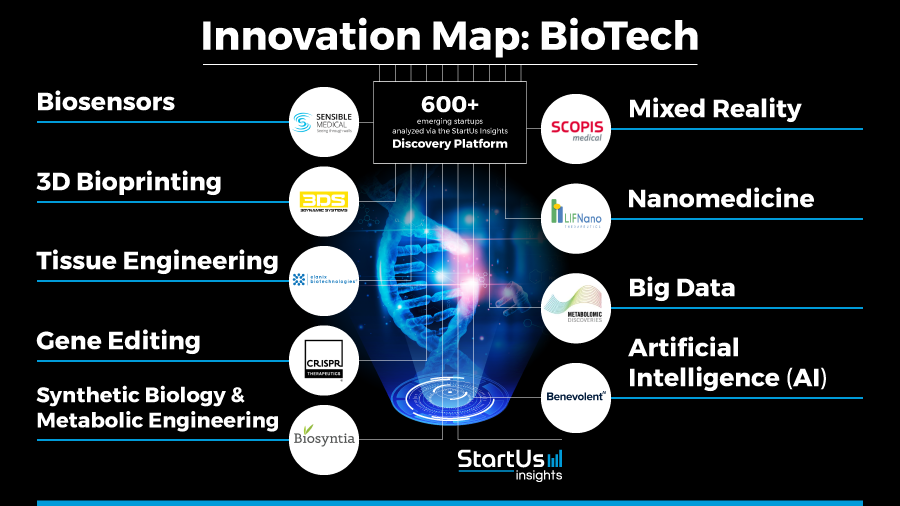

Photo taken from StartUs Insight

Biotech companies are at the forefront of scientific and technological advancements. The year 2023 saw significant breakthroughs, including developing new gene therapies, personalized medicine, and advancements in CRISPR technology.

The pipeline of biotech innovations is robust, with numerous companies on the verge of bringing new treatments to market. This pipeline creates a strong foundation for these companies to go public, as they can attract investors eager to capitalize on future medical breakthroughs.

3. Increased Funding and Investment

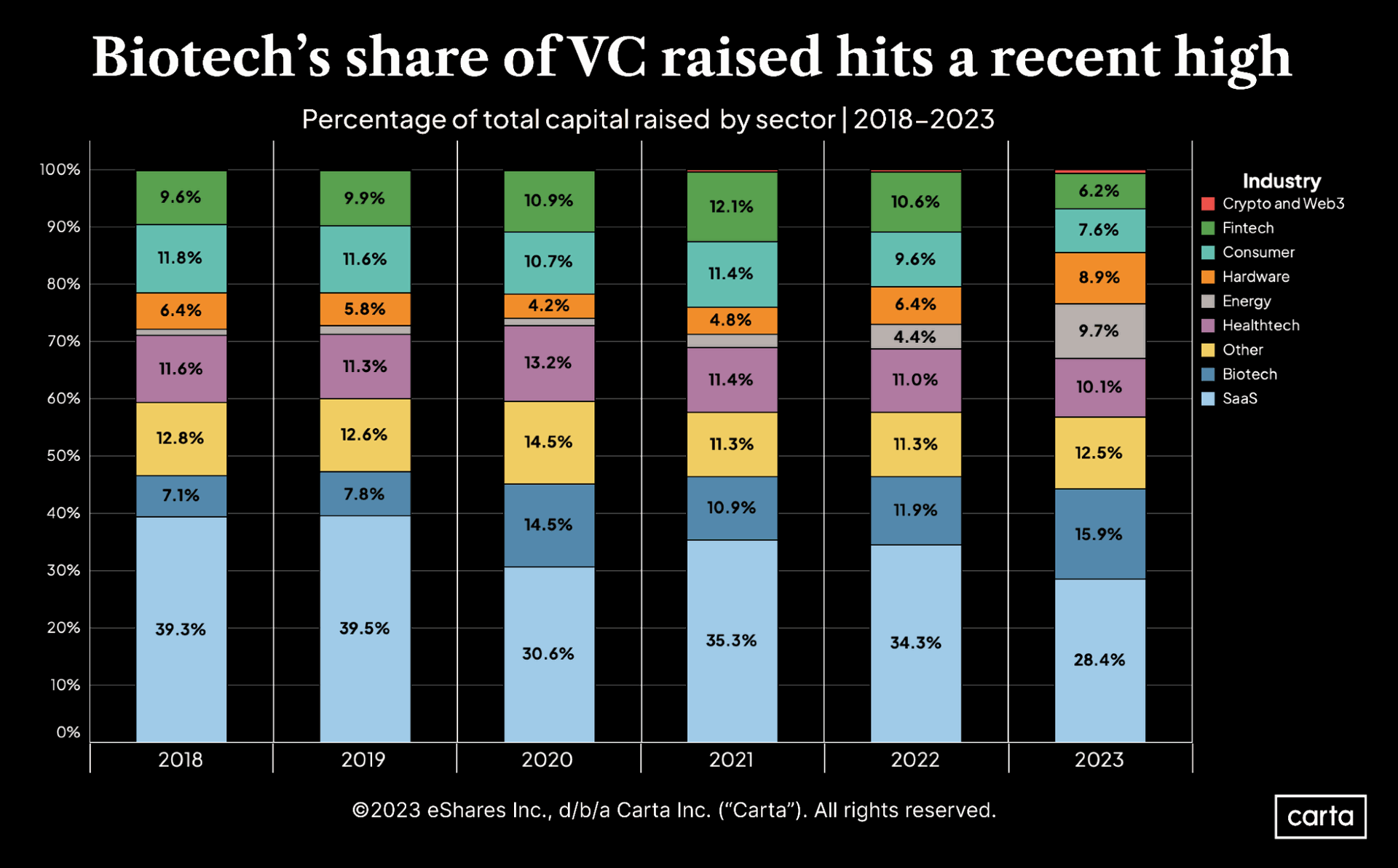

Venture capital (VC) investment in biotech has been robust. In 2023, biotech companies in the U.S. raised over $20 billion in venture capital, a substantial increase from previous years. This influx of capital has provided the necessary resources for research and development and positioned these companies to be more attractive candidates for IPOs.

Additionally, special purpose acquisition companies (SPACs) have become a popular vehicle for biotech firms to go public, offering an alternative to the traditional IPO route and increasing the overall number of companies entering the public market.

4. Regulatory Support and Fast-Track Approvals

The regulatory environment for biotech companies has been increasingly supportive. The U.S. Food and Drug Administration (FDA) has introduced various programs to accelerate the approval process for promising treatments, such as the Breakthrough Therapy designation and the Fast Track designation.

In 2023, the FDA granted Fast Track designation to over 30 biotech products, indicating a streamlined path to market for these innovations. This regulatory support reduces the time and cost of bringing new treatments to patients, making biotech companies more appealing to investors and suitable candidates for IPOs.

5. Growing Public and Market Demand

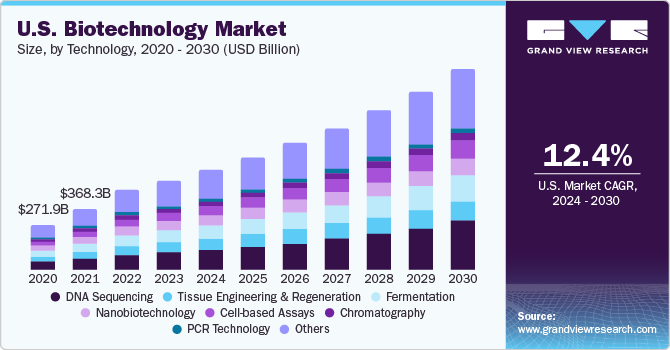

The global biotechnology market was valued at approximately $752 billion in 2023 and is projected to reach $1.2 trillion by 2030, growing at a CAGR of around 8.7%. This increasing demand is driven by an ageing global population, the rising prevalence of chronic diseases, and the continuous need for new and effective treatments.

Investors are keen to tap into this expanding market, making IPOs a lucrative option for biotech companies looking to raise capital and expand their operations.

Future of Biotech Business

As companies continue to innovate and address critical health challenges, their entry into the public market is likely to attract substantial investor interest and drive further growth in the biotechnology sector as global issues are likely to increase such as:

- In an ageing population, better medication and treatment are needed to prolong the lifespan

- Global warming; affecting agriculture

- Wildlife conservation; understanding how to protect our environment better

- Food alternatives to replace or reduce certain products from being overused

This trend underscores the importance of biotechnology in shaping the future of healthcare and its potential to deliver transformative solutions to global health issues.

Importance of Going IPO Especially for Biotech Businesses

An IPO can be a transformative event for biotech companies, providing the necessary capital and market presence to drive innovation, growth, and success. However, it is a significant decision that requires careful planning and consideration of both the benefits and the challenges involved.

For most biotech companies to succeed, understanding how to raise capital and receive equity through IPO is part of the process to receive. To grow in regional and International markets, it is almost certain that founders and business owners need to understand the importance of bringing the company into the public market.

At PIF Capital, we fast-track investors, SMEs, and business owners with the power to earn higher profits through IPO (initial public offering). If you are interested in understanding more about how to make your business sexy, bankable, and destructive, then reach out to us at PIF Capital.

If you are looking to raise equity and IPO your business, do join our weekly IPO3 session, conducted every Tuesday from 9 am to 12 pm.