Buying IPO stock can be a thrilling way to start investing in the stock market. IPOs, or Initial Public Offerings, are when a company first sells its shares to the public. This guide will help you understand what IPOs are, how to research and buy them, and what to watch out for.

Key Takeaways

- IPOs are when a company sells its shares to the public for the first time.

- It's important to research a company's financial health and market potential before investing in its IPO.

- Choosing a good brokerage is crucial for accessing IPO stocks.

- There are risks involved with IPO investments, so it's important to be cautious.

- Learning from past successful and failed IPOs can provide valuable insights.

Understanding Initial Public Offerings

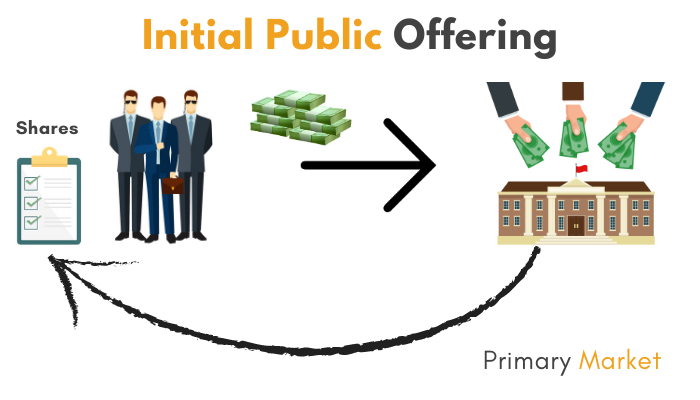

An Initial Public Offering (IPO) is when a company first sells its shares to the public. This event marks the transition from a private entity to a publicly traded company. IPOs are like grand openings for companies, inviting you to become a shareholder and participate in their growth journey.

Steps Involved in an IPO

The IPO process starts with a private company deciding to go public. The company then hires an underwriter to help them prepare for the IPO. The underwriter will help the company prepare a prospectus, which is a document that provides information about the company and the IPO. Issuing an IPO involves several steps, as follows:

- Decision to Go Public: The company decides to offer its shares to the public.

- Hiring Underwriters: The company hires investment banks to manage the IPO.

- Filing with Regulatory Bodies: Necessary documents are filed with regulatory authorities.

- Marketing the IPO: The company and underwriters promote the IPO to potential investors.

- Setting the IPO Price: The price of the shares is determined.

- Going Public: Shares are offered to the public and start trading on the stock exchange.

Role of Underwriters

Underwriters play a crucial role in the IPO process. They help the company prepare the prospectus, file necessary documents, and market the IPO to potential investors. They also assist in setting the IPO price and ensure that the shares are sold. Underwriters are typically investment banks that have experience in managing IPOs.

Regulatory Requirements

Regulatory requirements are essential to ensure that the IPO process is fair and transparent. Companies must file necessary documents with regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States. These documents include the prospectus, which provides detailed information about the company and the IPO. Compliance with regulatory requirements is crucial for the success of the IPO.

The IPO process is a major undertaking that involves precise planning and the cooperation of many different parties. It’s not just a big decision—it’s a big project, with lots of moving parts.

How to Research a Company Before Its IPO

Before investing in an IPO, conducting thorough research is essential. Here are some key steps to consider:

Evaluating Financial Health

To understand a company's financial health, start by examining its balance sheet, income statement, and cash flow statement. Look for consistent revenue growth and profitability. Pay attention to debt levels and how the company manages its expenses. A strong financial foundation is crucial for long-term success.

Assessing Market Potential

Evaluate the company's market potential by analysing its industry, target audience, and competitive landscape. Consider the size of the market and the company's position within it. Is the market growing, and does the company have a competitive edge? These factors can significantly impact future growth.

Understanding the Prospectus

The prospectus is a document that provides detailed information about the company’s business model, financials, risks, and future prospects. It is crucial to read and understand this document to assess the potential of the company and its IPO. Pay special attention to the risk factors and use of proceeds sections.

Thorough research can help you make informed decisions and avoid common pitfalls when investing in IPOs.

Steps to Buy IPO Stock

Before you can buy IPO stock, you need to make some preparations. Ensure you have an online account with a broker that offers IPO access. Brokers like Robinhood and SoFi Active Investing provide this service. Check if you meet the eligibility criteria, which might include minimum asset requirements. Once you qualify, you may need to fill out a form with your broker to request shares.

When the IPO is about to go live, you need to place an order. Decide how many shares you want to buy and at what price. This is similar to buying any other stock. If you don't qualify to buy an IPO before it’s available to the general public, you’ll have to wait until the stock debuts on an exchange. At that point, buying an IPO is just like any other stock.

After purchasing the IPO stock, monitor its performance. Keep an eye on market conditions and company news. This will help you decide whether to hold onto the stock or sell it. Remember, the first few days of trading can be volatile, so stay informed and make decisions based on research and market trends.

Investing in IPOs can be exciting but requires careful planning and attention to detail. Make sure you understand each step to maximise your investment potential.

Risks and Rewards of Investing in IPOs

Investing in IPOs can be an exciting opportunity for beginners in the stock market. IPO investments can offer an excellent opportunity to invest in emerging companies with significant growth potential.

Being an early investor can allow you to participate in a company’s early growth stages, potentially resulting in substantial returns. IPOs often involve companies operating in innovative and disruptive industries. Investing in these companies can provide exposure to groundbreaking technologies and business models.

However, investing in IPOs carries certain risks that investors should be aware of:

- Volatility: IPO stocks can experience significant price volatility in the initial days or weeks of trading. Prices may surge or drop dramatically, driven by market sentiment, media coverage, and investor demand. Be prepared for short-term fluctuations.

- Limited Historical Data: Newly public companies may still be finding a path to profitability and have a management team that’s relatively untested, particularly as a public company. This lack of historical data can make it challenging to predict future performance.

- Potential Overvaluation: Early excitement can lead to overvaluation, where the stock price is higher than the company's actual worth. This can result in significant losses if the market corrects itself.

To navigate IPOs confidently, conduct thorough research, assess risks, and make informed decisions. Understand the company’s fundamentals, evaluate its growth potential, and analyse the IPO valuation. Consider the reputation of underwriters and be cautious of hype. Diversify your portfolio, align your strategy with your goals, and stay informed.

Beyond the risks of investing in any individual stock, there are additional risks associated with IPOs. Newly public companies may still be finding a path to profitability, have a management team that’s relatively untested, and may disappoint on the stock market’s expectations.

Common Mistakes to Avoid When Buying IPO Stock

Investing in IPOs can be thrilling, but it's easy to make mistakes. Here are some common pitfalls to watch out for:

Overlooking Research

One of the biggest mistakes is not doing enough research. Many investors get caught up in the excitement and fail to evaluate the company's fundamentals. Always read the S-1 prospectus and other financial documents.

Ignoring Market Conditions

Market conditions can greatly affect the success of an IPO. Ignoring these can lead to poor investment decisions. Keep an eye on market trends and economic indicators.

Investing Based on Hype

It's easy to get swept up in the hype surrounding a hot IPO. However, investing based on hype rather than solid research can be risky. Always base your decisions on thorough analysis.

Failing to diversify: putting all of your money into a single stock or sector can be risky. It's crucial to diversify your portfolio across different stocks, sectors, and asset classes.

Failing to Diversify

Putting all your money into a single IPO can be very risky. Diversify your investments to manage risk effectively.

Not Setting Realistic Expectations

While some IPOs generate substantial returns, not all do. Set realistic expectations and be prepared for fluctuations or even losses.

Case Studies of Successful and Unsuccessful IPOs

One of the most notable successful IPOs is Facebook. When Facebook went public in 2012, it raised $16 billion, making it one of the largest tech IPOs in history. Facebook's IPO was a game-changer, setting the stage for other tech giants to follow. Another example is Alibaba, which raised a staggering $25 billion in 2014, marking the largest IPO ever. These companies had strong financials, a clear market potential, and were backed by famous underwriters.

On the flip side, not all IPOs have a happy ending. Take the case of WeWork. Initially valued at $47 billion, WeWork's IPO was a disaster due to poor financial health and questionable business practises. The company had to withdraw its IPO, and its valuation plummeted. Another example is Pets.com, which went public during the dot-com bubble. Despite the hype, the company failed to turn a profit and went bankrupt within a year.

Key Takeaways

- Research is crucial: Always evaluate a company's financial health and market potential before investing.

- Beware of the hype: Just because a company is popular doesn't mean it's a good investment.

- Learn from the past: Studying successful and failed IPOs can provide valuable insights.

Navigating these challenges requires careful planning, expert advice, and strategic decision-making. In the next section, we’ll look at the real-world impact of an IPO on a company and consider some case studies to see how different companies have managed their transitions to public ownership. Stay tuned for more insights into the transformative power of going public!

Legal and Tax Implications of IPO Investments

When you invest in an IPO, it's crucial to understand the tax obligations that come with it. Gains from selling IPO shares are often considered capital gains. Depending on how long you hold the shares, these gains can be classified as either short-term or long-term, each with different tax rates.

Navigating the legal landscape of IPO investments can be complex. Companies must comply with various laws and regulations, which can be both time-consuming and costly. Errors in documentation can lead to delays or penalties. It's essential to stay updated on initial public offering laws and regulations in your region.

Investors must also be aware of the reporting and compliance requirements. This includes keeping accurate records of all transactions and understanding the specific forms that need to be filed. Failure to comply with these requirements can result in fines or other legal consequences.

Investing in IPOs involves understanding both the legal and tax implications to avoid potential pitfalls. Seek professional advice if needed to navigate this complex landscape effectively.

Long-term Strategies for IPO Investors

One of the most important strategies for long-term IPO investors is diversification. Avoid allocating a substantial portion of your portfolio to a single IPO. Instead, spread your investments across different asset classes and industries to manage risk effectively. This approach helps in mitigating potential losses and ensures a balanced investment portfolio.

Before diving into IPO investments, it's crucial to define your investment goals. Determine whether you are seeking short-term gains through IPO “flipping” or aiming for a long-term investment in a promising company. Align your strategy with your goals and risk tolerance to make informed decisions.

Regularly monitoring your investments is key to long-term success. Keep an eye on market trends and the performance of your IPO stocks. Develop a robust investment thesis and focus on long-term trends for a successful investment strategy in a fast-paced investment landscape.

Stay informed and be cautious of hype. With a cautious approach and a commitment to continuous learning, IPO investing can be a rewarding part of your investment journey.

Global Perspectives on IPO Investments

The global IPO landscape is diverse, with different regions showing varying levels of activity and success. In Q1 2024, a majority of key IPO markets witnessed a significant number of newly issued IPOs whose current share prices surpassed their offer prices. This trend highlights the potential for substantial returns in certain markets.

Different countries have unique processes and regulations for IPOs. For instance, while Western IPO markets reopened in Q1 2024, global IPO values were down in the first quarter compared to the equivalent period last year. This indicates that market conditions and regulatory environments can significantly impact IPO performance.

Emerging markets often present lucrative opportunities for IPO investments. These regions may offer access to innovative and disruptive industries, providing exposure to groundbreaking technologies and business models. However, it's essential to understand the specific risks and rewards associated with investing in these markets.

When considering IPO investments globally, it's crucial to evaluate the financial health and market potential of companies, as well as the regulatory landscape of the region.

Conclusion

Investing in IPO stocks can be an exciting way to enter the stock market and potentially profit from new companies. However, it's important to approach this opportunity with caution and thorough research. By understanding the IPO process, evaluating the company's fundamentals, and considering the risks involved, you can make informed decisions.

At PIF Capital, we fast-track investors, SMEs, and business owners with the power to earn higher profits through IPO (initial public offering).

Jonathan Por; our Founder and Chairman of PIF Capital is a serial entrepreneur with 30 years of experience. Throughout the years at PIF Capital, we have built an exclusive capital community with over 40,000 SME community members, and share formulas created by PIF Capital such as the CPTK(Capital, Professional, Talent, Keymanship) model, 3F(Friend, Family, Fans) model, and the ABC(A+ entrepreneur, Business model, Capital) model.

Frequently Asked Questions

What is an IPO?

An IPO, or Initial Public Offering, is when a private company sells its shares to the public for the first time.

How can I buy IPO stock?

To buy IPO stock, you'll need a brokerage account. Once the IPO is available, you can place an order through your broker.

What are the risks of investing in IPOs?

Investing in IPOs can be risky. The stock price might drop after the IPO, and the company may not perform as expected.

How do I research a company before its IPO?

Look at the company's financial health, market potential, and read its prospectus. This will give you an idea of its strengths and weaknesses.

What is the role of underwriters in an IPO?

Underwriters help the company go public. They set the IPO price, buy the shares from the company, and sell them to the public.

Can I sell my IPO shares immediately after buying them?

Yes, you can sell your IPO shares right after buying them. However, it's often better to wait and see how the stock performs.

Are there any tax implications when buying IPO stock?

Yes, there can be tax implications. You might have to pay taxes on any profits you make from selling the shares.

What should I do if the IPO stock price drops after I buy?

If the stock price drops, don't panic. Consider holding onto the shares to see if the price recovers over time.