PIF Capital launched its very first SAP(SME Accelerator Program) in 2022 together with Antz Capital to fast-track business growth towards IPO. Chairman Jonathan Por launched this program as a means to expand the regional market.

Having completed over 80 SAP projects and 120 equity fundraising, PIF Capital is continuously improving the SAP service to elevate SME business owners' ability to get into the capital market.

Why Business Owners Sign Up For PIF Capital’s SAP?

Our one-of-a-kind programme, led by experienced SME owners with over 30 years of entrepreneurs Jonathan Por and 20 years of corporate finance director background in PwC Clarence Chong, this program will equip you with the skills needed to raise Other People's Money (OPM) and acquire Other People's Profits (OPP) through the capital market.

What Services Are Provided In the SAP Program

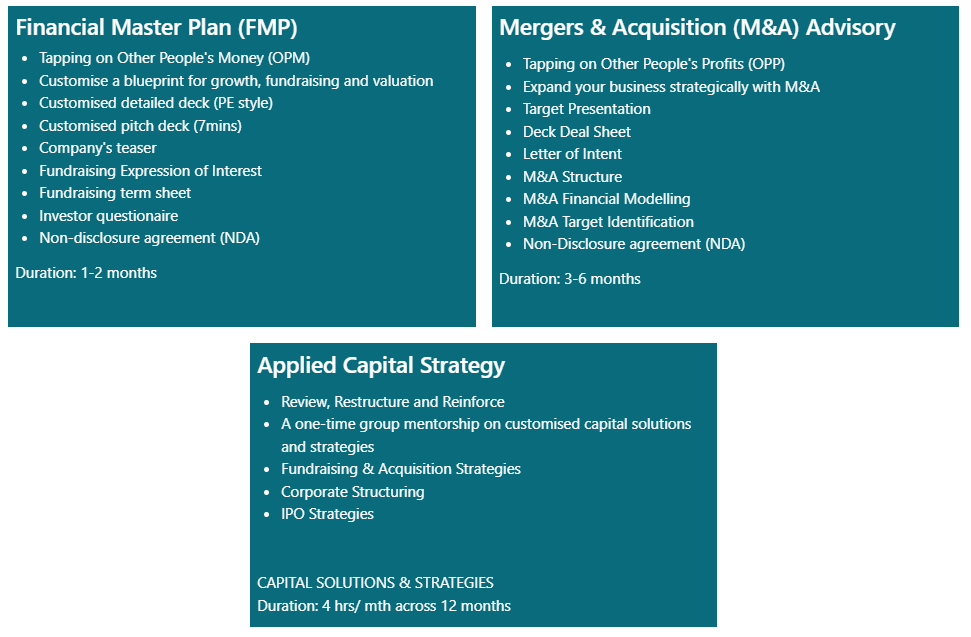

Working hand in hand with SME business owners, this 12-month program will cover:

- Financial Master Plan

- Utilizing Merger & Acquisition(M&A) Advisory

- Applied Capital Strategy

Within these 12 months, our goal is to maximise the ability for our clients raise capital from the capital market.

After signing up for SAP, SME business owners can have access to PIF Capital’s external corporate finance team, which will develop the tools needed to attract investors, talent, and business partners. The programme also focuses on building inorganic growth strategies, allowing you to create a strong and sustainable business that can last for generations.

Here’s what our clients can expect:

Financial Masterplan

The reason most SME business owners subscribe to our SAP programme is to gain access to our external corporate finance team through our sister company Antz Capital.

With a cumulative track record of USD 3 billion fundraised, PIF Capital’s Corporate Finance Director Clarence Chong and Antz Capital’s Executive Director Henry Lim are tasked to spearhead each project. They are recommending the best strategy to create an appealing financial masterplan that attracts investors.

To add greater value, our research team actively pump out the latest content sources from various news platforms to keep our SAP members up-to-date with the latest market trends.

Utilizing Merger & Acquisition(M&A)

With over 40,000 SME community members, our SAP members can leverage our support network to find and acquire business partners through M&A. With 10 regional countries working hand-in-hand, we help our SAP members understand how to effectively take advantage of M&A.

In today’s tech-driven space fast-tracked by the COVID-19 pandemic lockdown, finding a CTO(Chief Technology Officer) or business with an effective app/webpage can be challenging. Companies are looking to avoid R&D(research and development) to jump straight to R&A(research and acquisition) to reduce cost and increase business efficiency.

Another important aspect is to avoid constant battles with competitors. There’s a saying in business: ‘Your enemy might not even be your competitor, it's usually who you don't know’.

Nokia and Motorola both lost out to their competitor Apple, a company that specializes in computers. Both companies lost because they weren’t able to cooperate and support one another’s innovation growth. We have seen other similar cases such as Tesla EV overtaking automotive and SpaceX taking over space exploration.

Applied Capital Strategy

Every month, we host our SCE(SME Capital Enterprise) week to get our members to review, restructure, and reinforce our member's pitch deck to ready themselves for the capital market.

Through our events, members can constantly train on their pitching skills, upgrade their pitch deck to show investors, and learn pointers from angel investors themselves on how to improve their business.

Our Track Record

Since its inception, PIF Capital has successfully fundraised many SMEs and launched successful IPO cases.

GS Holding Founder, Mr Pang Pok has been trying to IPO for many years and has failed to do so twice until he met Guru Jonathan. Even though the company was making a loss of $103k in 2016, the dishwashing company was able to successfully list on Catalist SGX for $31 million. In 2022, the company is now worth $67 million and make $1.7 million in annual profit.

Another successful case PIF Capital has supported is Natural Cool Holdings Limited; a company that sells primarily air-conditioning and wasn’t making a huge profit. After understanding the SPV(Special Purpose Vehicle) model and how to utilise it effectively as a capital entrepreneur, Guru Jonathan was able to bring in S-Team Switchgear for a collaborative IPO of $24 million.

To IPO and Beyond

In 2027, our goal to IPO is on track. As we steadily increase the number of IPO closures, we are moving towards building a corporate brand to support more SME business owners to understand and take advantage of the opportunity that lies ahead in the capital market.