Established in 2006, Guzman y Gomez was established in Sydney by New York City duo Steven Marks and Robert Hazan and operates over 200 restaurants in Australia, Japan, Singapore and the United States. Over the next 20 years, the company is expected to grow more than 5 times, and expand its market share in the fast-food establishment.

By the end of this month, the company is expected to go IPO (initial public offering) by offering 11.1 million shares at $22 per share to raise approximately $242.5 m (the “Offer”), including approximately $200m in primary proceeds and $42.5m of secondary sell down on behalf of select existing security holders.

Primary proceeds of the Offer will be used to fund GYG’s growth strategy over the coming years, primarily focused on the significant expansion of its corporate restaurant network in Australia. The proceeds of the Offer will also provide substantial flexibility to accelerate this strategy if appropriate opportunities arise.

8 Reasons Why Guzman y Gomez Decide to IPO?

Backed by several notable VC (Venture Capital) firms such as Aware Super, Cooper Investors, Hyperion Asset Management, Firetrail Investments and QVG Capital, GYG's long-term prospects remain bright in the long-term.

Steven Marks, founder and co-CEO of GYG said:

“As we commence the next chapter as an ASX-listed company, our vision to reinvent fast food and change the way the masses eat will remain central to what we do. We truly believe that fast food doesn’t have to be bad food and we look forward to sharing our food with more guests across Australia and overseas as we look to realise the opportunity we have to grow our network to more than 1,000 restaurants over the next 20+ years,”

Hilton Brett, Co-CEO said:

“We expect our sales growth to continue through the opening of new restaurants and increasing sales in existing restaurants. We also expect our profitability to improve as we continue to improve our execution in restaurants and further leverage the benefits of our increasing scale. As a result, we expect Pro Forma EBITDA to grow from $29.3m in FY2023 to $59.9m in FY2025,”

Primary proceeds of the Offer will be used to fund GYG’s growth strategy over the coming years on the significant expansion of its corporate restaurant network in Australia. Over the next 20 years, The proceeds of the Offer will also provide substantial flexibility to accelerate this strategy if appropriate opportunities arise.

1. Access to Capital for Expansion

Going public allows GYG to raise significant capital from a wide pool of investors. Going public is popular because the benefits of an initial public offering (IPO) generally surpass the associated challenges or drawbacks. These advantages include:

- Access to Capital

- Increased visibility

- Opportunities for investors

- New form of business currency

- Improvements in the company's governance structure.

With the additional funds, GYG can open new outlets, invest in marketing, and enhance its supply chain and logistics infrastructure. These are essential fast-food chain business models to drastically increase business revenue.

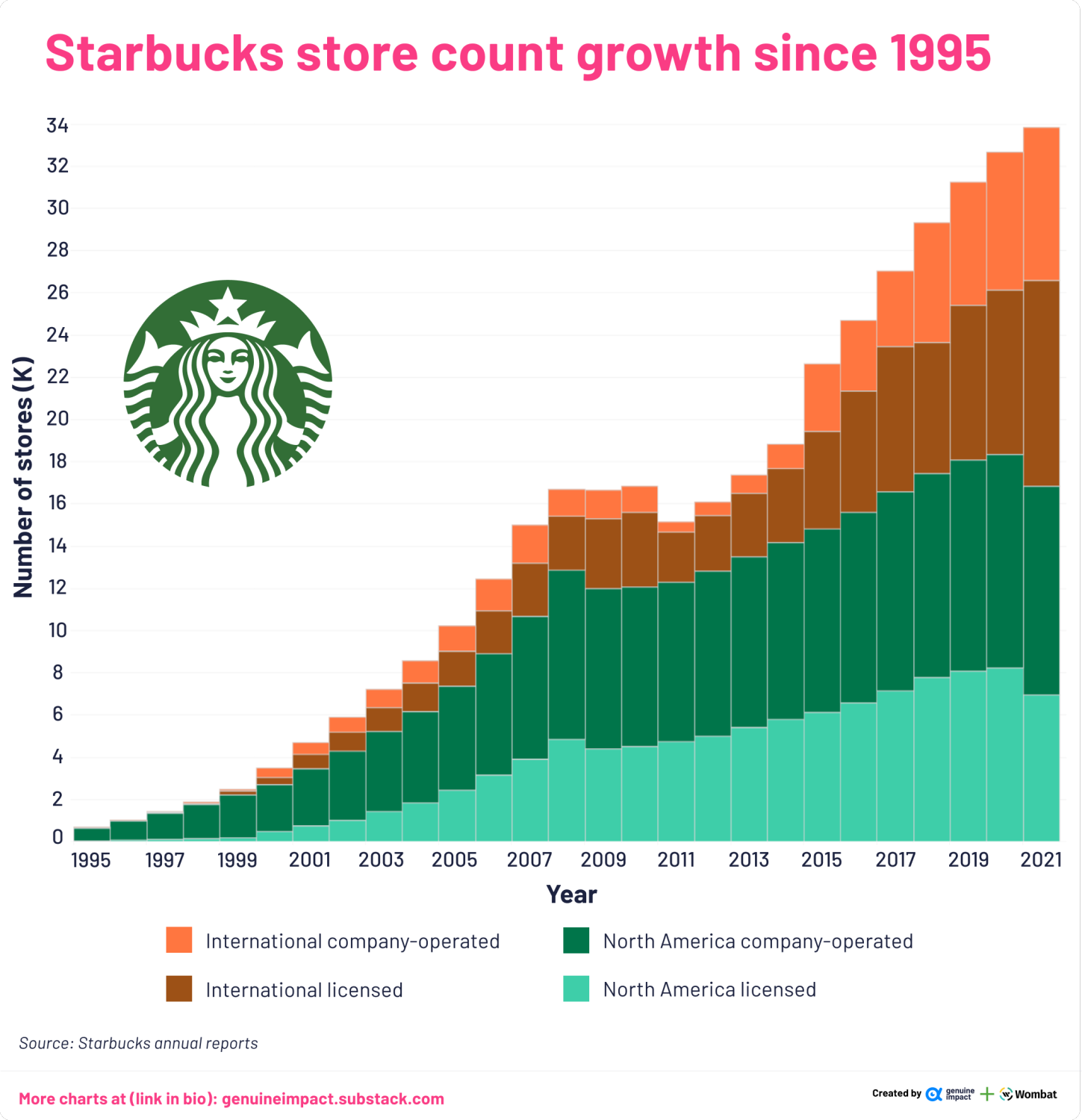

A good example is Starbucks, since its IPO in June 1992, it has been consistently expanding to new markets and now has over 34,000 stalls worldwide. The fast food chain business has always been focused on franchising as the best income-generating revenue which is paramount business expansion for GYG.

2. Brand Visibility and Credibility

Being publicly listed often increases consumer and investor confidence in the brand. By going public, companies are required to declare their earning every quarter to shareholders and potential investors so that it could excite the market to invest more in their business.

For GYG, this visibility can:

- Attract new customers

- Potential franchisees

- Business partners

- Bolstering its market position

With the company listed, investors can readily invest in the company, making fundraising for GYG almost unnecessary if they can convince the public market to invest more in it.

3. Employee Incentives

Publicly traded companies can offer stock options and shares to employees, which serves as a powerful incentive and retention tool to hit certain sales targets. By going public, GYG can motivate its workforce and align employee interests with the company's long-term success.

4. Debt Reduction

An IPO provides an opportunity to pay down existing debt. As previously mentioned, GYG expects to use $42.5m of secondary selldown on behalf of select existing security holders. This can help reduce current debt and improve GYG’s financial health and flexibility, allowing for reinvestment into the business rather than servicing interest payments.

5. Market Timing

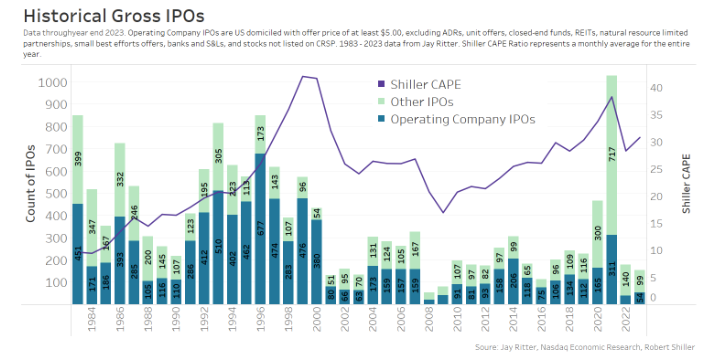

Capital markets are dynamic, and companies typically opt to go public when conditions are favourable. Since the last IPO boom in 2021(mainly due to SaaS and crypto), the financial market has gradually recovered, instilling greater confidence in businesses considering an IPO. This renewed stability encourages companies to list their shares, taking advantage of the improved market environment.

This includes periods of high investor appetite for new listings and strong performance in the food and beverage sector. By timing their IPO correctly, GYG can maximize the capital raised and secure better terms.

6. Valuation and Shareholder Liquidity

Going public provides a market valuation for the company, which can be beneficial for founders, early investors, and employees. It offers them liquidity and the ability to realize gains from their investments and shareholdings that they may have invested for years(rewarded for their trust in the brand).

7. Strategic Growth Initiatives

An IPO can support various strategic initiatives beyond opening new locations. For GYG, this could include enhancing digital capabilities, developing new product lines, or exploring potential acquisitions to diversify and strengthen its market presence.

For example, McDonald's has heavily invested in robotic technology for the company's services such as cashiering and delivery to be managed by AI. By introducing various strategic initiatives, GYG can potentially increase its restaurant efficiency and earnings.

8. Market Differentiation

By being a publicly traded company, GYG can differentiate itself from competitors who are still privately held. This status can be leveraged in:

- Marketing

- Negotiations

- Partnerships

Thus, positioning GYG as a leader in the fast-food dining sector. With that, PR strategy and business quarterly earnings could potentially increase the share prices and increase GYG business growth substantially.

Why Entrepreneurs Need to Understand How to Raise Capital

9 out of 10 businesses fail within their first year of the business. 82% of which close because of cash flow issue. Not surprising there.

There’s a common saying “Got money better than no money”.

Understanding how to raise capital is fundamental for entrepreneurs as it directly influences their ability to grow, sustain, and scale their businesses. Understanding them can also help entrepreneurs to strategically manage resources, mitigate risks, and leverage opportunities in a competitive market.

This knowledge is not just about obtaining money but also about making informed decisions that will shape the future success of their enterprises. That’s why at PIF Capital, we help entrepreneurs understand how to become capital entrepreneurs through learning our PIF Angel Fundraising 4Ps Framework :

1. Pitching Plan

2. Pitching Schedule

3. Potential Investor Sourcing Strategy

4. Pitching Skillset

If you are interested in finding out more, be sure to join our weekly free meeting on IPO3 that we have to help SMEs and business owner kickstart their IPO journey.