The onset of the coronavirus pandemic in early 2020 created a seismic shift across numerous industries, with the travel and hospitality sectors among the hardest hit. During those times, many businesses choose to shut operations, retrench staff, and cut costs drastically. Companies like Singapore Airlines fired 4,300(20%) employees, Hotel Banyan Tree laid off 30% of their staff, and Resort World Sentosa too laid off 30% of their staff.

Although Airbnb was burning $ USD 1.2 billion in cash in the first half of 2020, the company managed to turn the challenges into opportunities, culminating in a historic Initial Public Offering (IPO) now worth $47 billion.

This remarkable feat not only underscored Airbnb's resilience but also transformed it into a billion-dollar success story. Here’s how Airbnb's strategic moves and robust business model propelled it to such heights amid a global crisis.

How Airbnb Survive Thanks To IPO

If there's one crucial lesson SMEs and business owners should understand about IPOs, it's that they can serve as a vital lifeline for raising equity and navigating through challenging financial periods.

Adapting to the New Normal

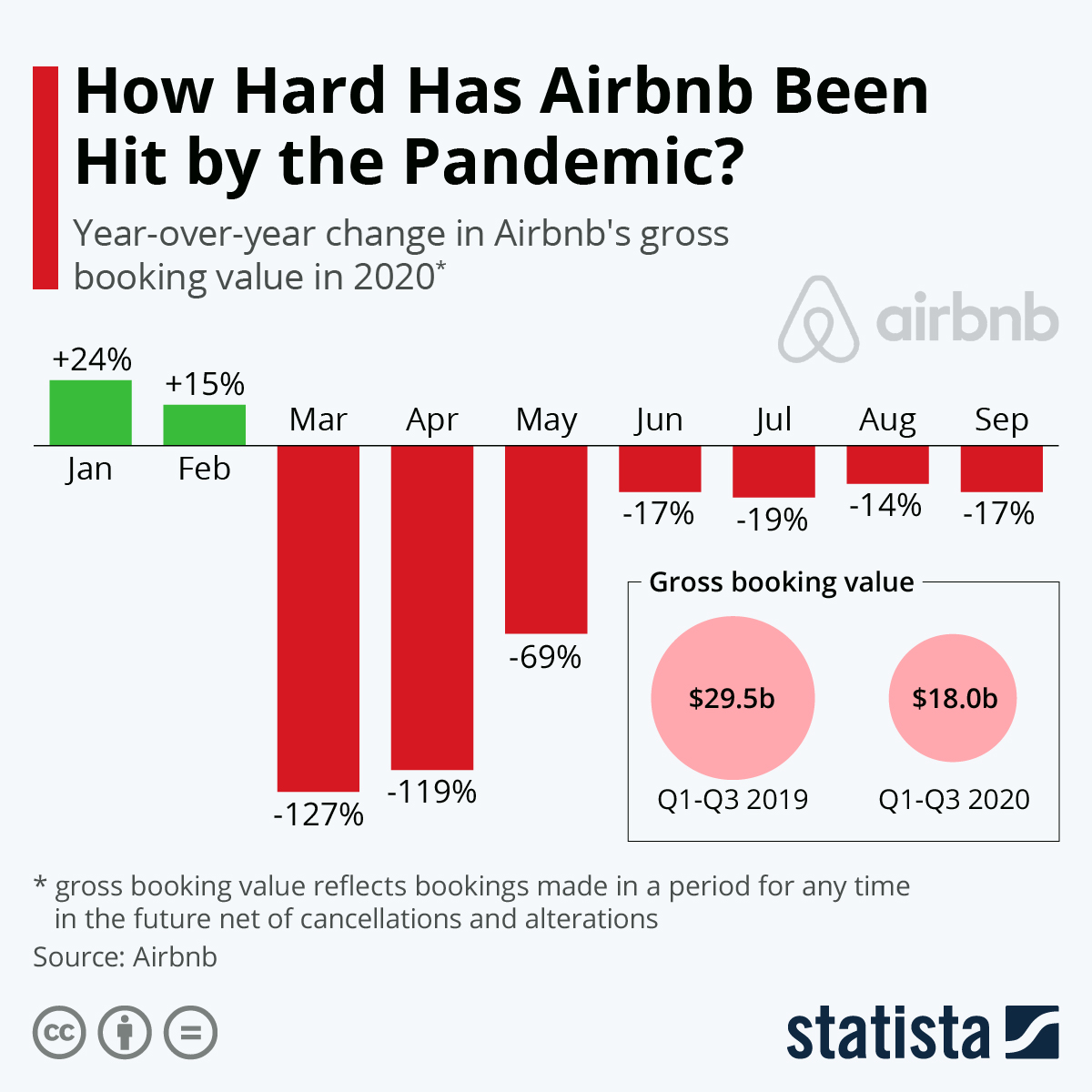

When the pandemic brought global travel to a standstill, Airbnb faced unprecedented cancellations and a drastic drop in bookings. According to Statista, the first 2 months of lockdown saw more than 100% decrease in gross booking revenue.

However, the company quickly pivoted by implementing several key measures:

- Flexible Booking Policies: Airbnb introduced flexible cancellation policies to build customer trust and ensure their comfort during uncertain times.

- Enhanced Cleaning Protocols: They launched the “Enhanced Clean” program, providing hosts with detailed guidelines to maintain high hygiene standards, thereby ensuring guest safety.

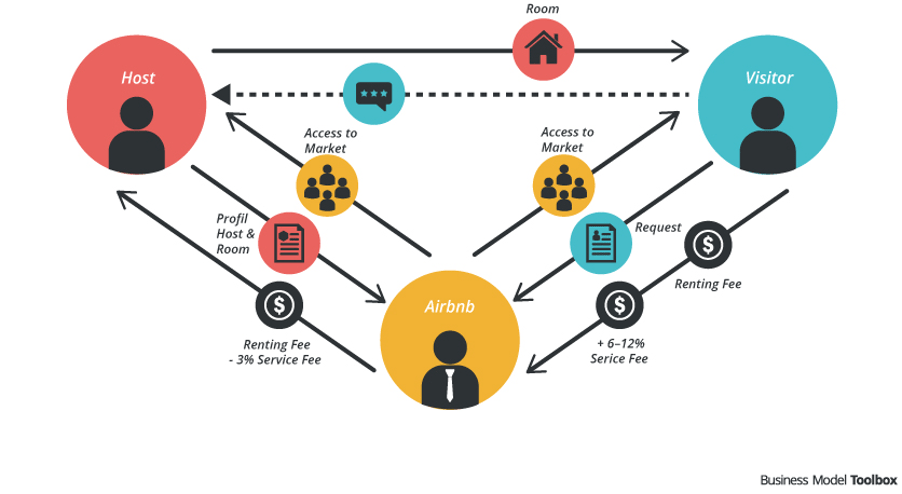

With travel restrictions in place, the demand for short-term rentals plummeted. Airbnb adapted by promoting long-term stays, catering to people seeking temporary relocations, remote workspaces, and extended vacations.

To this day, one enduring source of revenue for the business is the "cleaning fee," a feature that users now greatly appreciate. This strategic pivot helped Airbnb tap into a new market segment and maintain a steady revenue stream.

Leveraging Technology and Data

Investment in technology played a crucial role in Airbnb's success. Since August 2023, Airbnb has been actively investing in AI to smoothen their business.

Its AI will be focused on:

- Improving User Interface: Enhancing the website and mobile app to provide a seamless and user-friendly experience.

- Robust Security Measures: Implementing advanced security protocols to protect user data and ensure safe transactions.

By utilizing its vast reservoir of data to enhance customer experiences, Airbnb will be able to:

- Offering personalized recommendations

- Understand user preferences and behaviour

- Suggest relevant listings

Looking at the before and after layout of Airbnb, it shows how conversion rates are becoming better thanks to enhanced customer experience.

The Road to IPO

Airbnb has been in the heart of the public. The public market wanted affordable hospitality services, and Airbnb is a solution provider. Although the pandemic took a beating to the company, its management team took several steps to bolster investor confidence ahead of the IPO:

- Financial Discipline: They streamlined operations and cut unnecessary expenses, which helped in improving the financial health of the company.

- Transparent Communication: Consistent and transparent communication with stakeholders about the company’s strategies and performance metrics fostered trust and credibility.

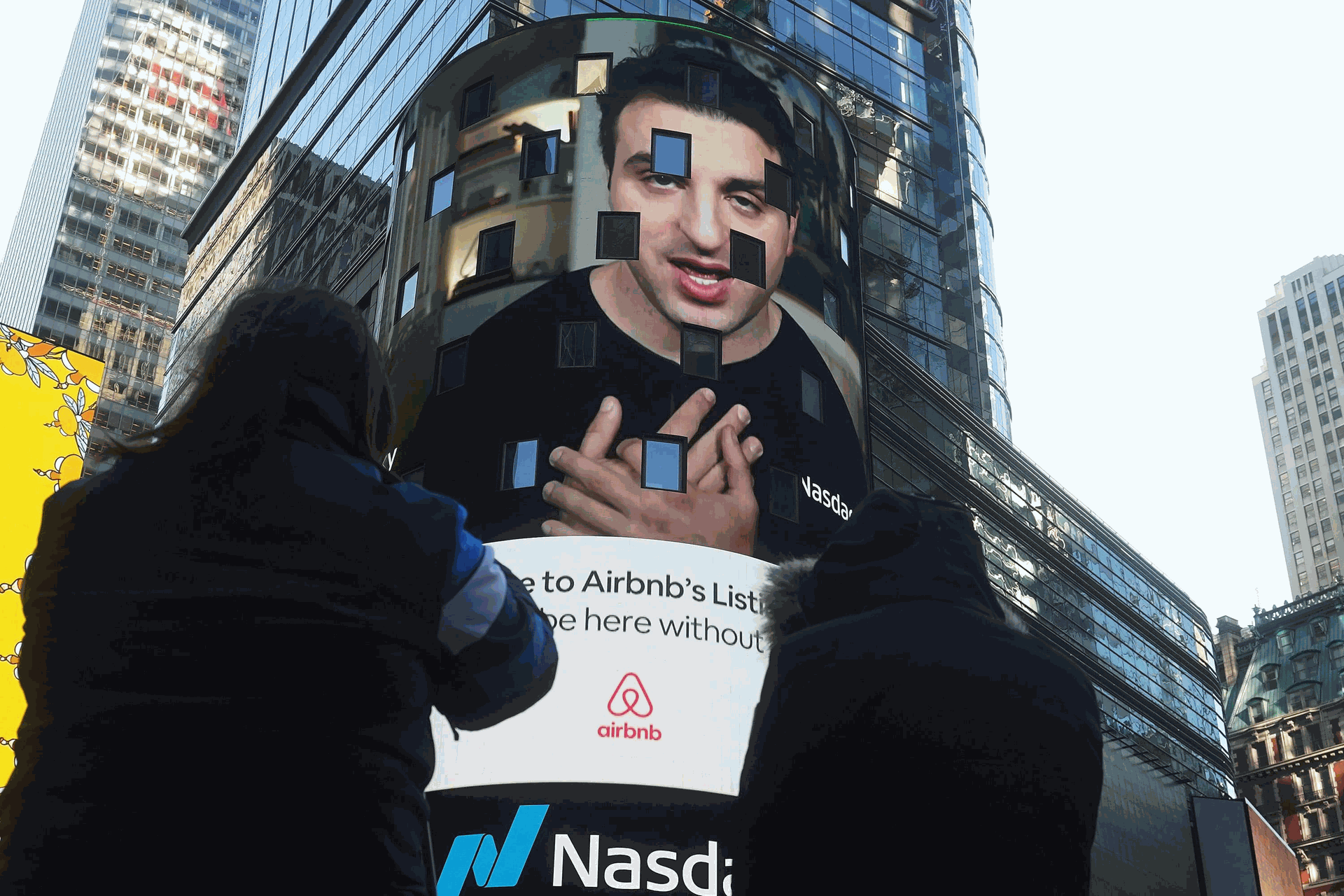

Despite the ongoing pandemic, Airbnb chose a strategic window for its IPO, capitalizing on a strong stock market and investor appetite for tech-driven businesses. This decision proved pivotal, allowing the company to raise $3.5 billion, with shares surging over 112% on the first day of trading.

Impact and Future Prospects

Airbnb’s successful IPO not only solidified its market valuation, making it one of the most valuable tech companies but also opened new avenues for growth. With a market capitalization exceeding $100 billion post-IPO, Airbnb had ample resources to invest in innovation, expand its market presence, and explore new business opportunities.

The IPO bolstered Airbnb’s brand strength, highlighting its resilience and ability to navigate through crises. This enhanced brand reputation attracted more hosts and guests to the platform, further fueling growth.

Post-IPO, Airbnb has focused on forming strategic partnerships and investing in technology to enhance its offerings. Innovations like Airbnb Experiences, which offer unique activities hosted by locals, continue to diversify revenue streams and enrich customer experiences.

IPO: A Great Lifevest for Business Owners

Airbnb's journey to becoming a billion-dollar success amid the coronavirus pandemic is a testament to its agile business strategy, innovative technology use, and keen market insights.

By adapting swiftly to changing circumstances, leveraging data effectively, and timing its IPO perfectly, Airbnb not only survived one of the toughest periods in modern history but also emerged stronger and more valuable.

As the world gradually recovers, Airbnb is well-positioned to capitalize on the rebound in travel and continue its growth trajectory.

Interested? Then be sure to join PIF Capital where we can do the same for businesses. From equity funding, networking events, and going IPO to earn more equity. We host our weekly IPO3 event every Tuesday from 9 am to 12 pm.

Discover how to:

- Maximise your business valuation.

- Generate today's cash flow from tomorrow's profit

- Continue to increase your share price post-IPO.

Register to secure your seat via this link:

Whatsapp to 82227413 for further enquiries.