Philippine-based Okada Manila, the casino resort controlled by Japan's Universal Entertainment Corp, is seeking a listing on the Philippine Stock Exchange (PSE) by 2025. Okada is expected to be valued between USD 500 million and USD 750 million for this IPO.

If the IPO is completed, it will be the third casino resort listed on the Philippine Stock Exchange. The previous two are Solaire, owned by Bloomberry Resorts Corp, and City of Dreams Manila, operated by Belle Corp, though City of Dreams has been delisted from the PSE in recent years.

Although the Philippines-listed entity linked to the operator of the Okada Manila casino resort in Manila says there is “no definite plan or decision to do an initial public offering (IPO) of Okada Manila.” Investors may be intrigued to know that Philippine stocks are expected to make a comeback.

Earlier this year, the PSE(Philippine Stock Exchange) announced it would double its number of IPOs in 2024 after a sluggish year that saw more delisting than debut. President Ramon Monzon said this is a positive outlook that comes on the back of expected rate cuts by the US and Philippine central banks, and increased infrastructure spending.

Overview of Okada Manila

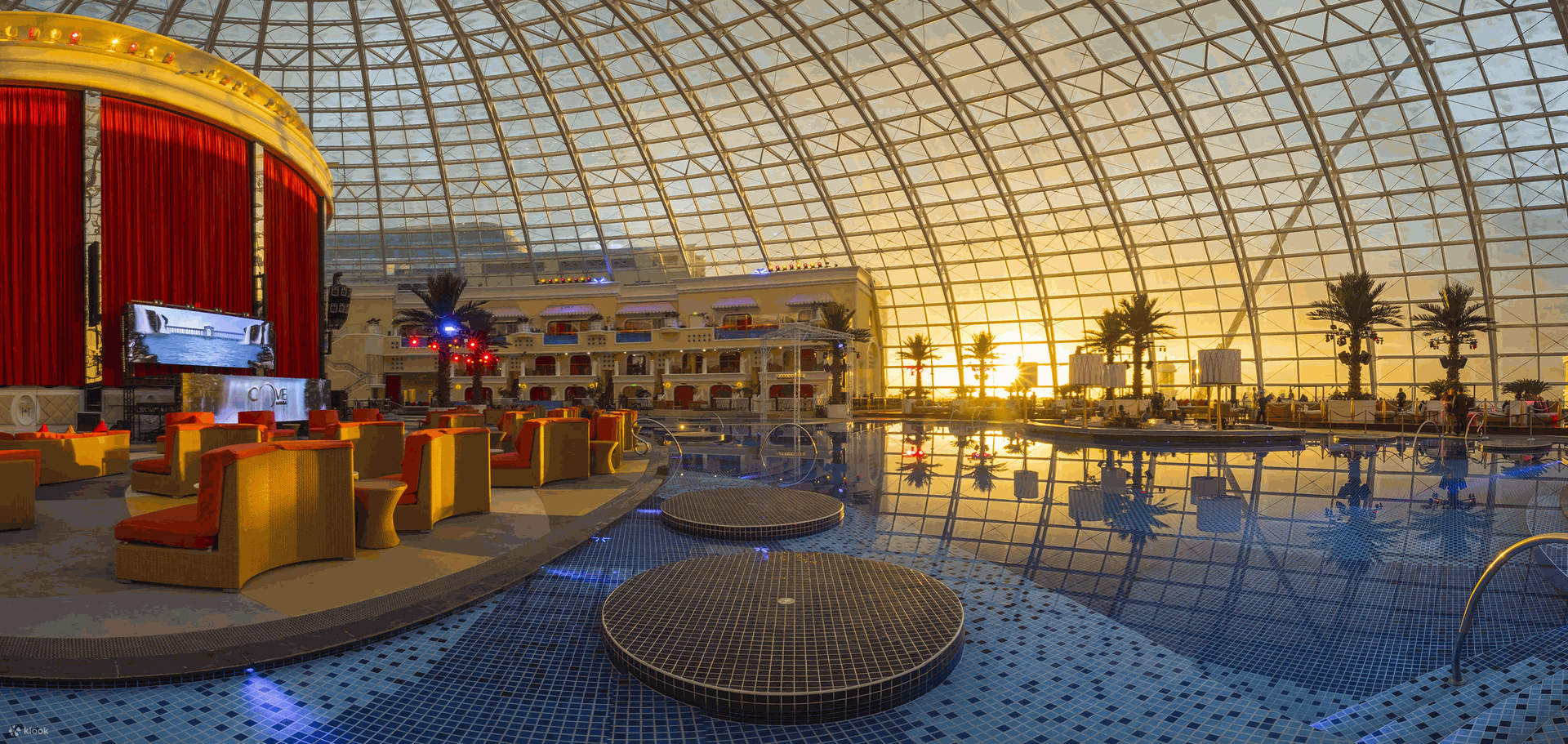

Situated in the heart of Manila's Entertainment City, Okada Manila is renowned for its luxurious accommodations, world-class gaming facilities, and diverse entertainment options.

The resort, spanning over 44 hectares, features a casino with thousands of gaming machines and tables, a five-star hotel, a retail promenade, and a variety of dining establishments.

Its iconic architecture and lavish amenities have made it a significant player in the region’s hospitality and gaming industry.

Why IPO Is A Strategic Timing

The timing of the IPO is crucial.

The global economy is showing signs of recovery, and the travel and tourism industry is rebounding from the effects of the COVID-19 pandemic.

By 2025, it is expected that international travel will have resumed to pre-pandemic levels, boosting the demand for luxury accommodations and gaming experiences.

We have seen an increase in spending on tourism for many countries in recent months, including companies like Siam Piwat(Thailand’s largest commercial real estate developer), and Airbnb growth (listed in 2021, its stock has steadily grown since 2022).

Moreover, the Southeast Asian market, particularly the Philippines, is experiencing rapid growth in tourism and entertainment. The Philippines has been attracting significant foreign investment and a growing number of tourists, making it an opportune moment for Okada Manila to expand its footprint.

Benefits for Investors

Investors are likely to find Okada Manila's IPO appealing for several reasons:

Strong Market Position - Okada Manila is one of the leading integrated resorts in the Philippines which received two-star awards from Forbes Travel Guide. The resort is a premier destination for hospitality and entertainment, the integrated resort has 993 exceptional accommodations ranging from 55 sqm deluxe rooms to capacious 1,400 sqm villas, including the newly-opened Tower Villas.

Growth Potential - The post-pandemic economic recovery and the growing Southeast Asian tourism market offer substantial growth opportunities. For investors, this space has been left out since the pandemic made investing in them highly risky. However, with an increase in government spending to develop the hospitality industry, some investors are looking at this as a great potential investment.

Diversified Revenue Streams - The resort’s diverse offerings, including gaming, hospitality, retail, and entertainment, provide multiple revenue streams, reducing financial risk. If Okada Manila goes public, the resort could potentially expand on these revenue streams.

Okada Manila’s Expansion Plans

The funds raised from the IPO will be channeled into several key areas:

Debt Reduction - Lowering debt levels to improve financial stability and reduce interest expenses. When Okada Manila goes IPO, it can clear debt and improve its financial record.

Infrastructure Development - Expanding existing facilities and adding new attractions to enhance the guest experience.

Service Enhancement - Okada Manila could invest in technology and training to improve service quality and operational efficiency. Integrating digital technology like fast booking transactions has made the user experience a seamless experience.

Why IPO is Ideal For Most Businesses

What benefits could getting publicly listed bring to SMEs, and what procedures are required in the process?

At PIF Capital, we focus on teaching our members the 3 key steps to get investors interested in your business, you can find out more by coming to our next IPO3 happening on:

- 📅18 June 2024

- ⏰ 9 am to 1 pm

Discover how to:

1. Maximise your business valuation.

2. Generate today's cash flow from tomorrow's profit

3. Continue to increase your share price post-IPO.

Register to secure your seats at https://pifcapital.sg/event/ipo3-english-18-june-2024-1382/register

Whatsapp to 82227413 for further enquiries.