Ola Electric has made a groundbreaking move by launching its Initial Public Offering (IPO), making it the largest IPO in India for 2024. This $734 million offering was fully subscribed by the second day, attracting significant interest from both institutional and retail investors. The funds raised will primarily be used to enhance Ola's manufacturing capabilities and research and development efforts, heralding a new era for the electric vehicle (EV) market in India.

Key Takeaways

- Ola Electric's IPO is the largest in India for 2024, raising $734 million.

- The IPO was fully subscribed on the second day, showing strong investor interest.

- Institutional investors like Nomura and Norges Bank bid heavily, contributing to the $447 million in bids.

- The funds will be used to boost manufacturing and R&D for Ola's e-scooters.

- This IPO marks a significant milestone in India's shift towards electric mobility.

Ola Electric's Historic IPO: A New Era for India's EV Market

Ola Electric, a significant Indian automaker, has made headlines with its historic IPO. The company aims to raise Rs 6,000 crore, marking the first major auto IPO since Maruti Suzuki. This move is expected to attract substantial interest from both institutional and retail investors.

This IPO is not just a financial milestone for Ola Electric but also a landmark event for India's auto industry. The success of this IPO is closely tied to government policies, particularly those promoting electric vehicles (EVs) and green technologies. The funds raised will help Ola Electric expand its manufacturing capabilities and invest in new product lines.

Ola Electric's IPO is often compared to Maruti Suzuki's historic public offering. While Maruti Suzuki set a benchmark in the traditional auto sector, Ola Electric aims to replicate this success in the burgeoning EV market. The company's innovative approach and strong market presence make it a promising investment opportunity.

Investor Response and Market Impact

Ola Electric's IPO has garnered significant attention from institutional investors. The company's innovative approach and strong market presence make it a promising investment opportunity. Institutional investors are particularly drawn to Ola Electric's potential for growth in the rapidly expanding EV market in India.

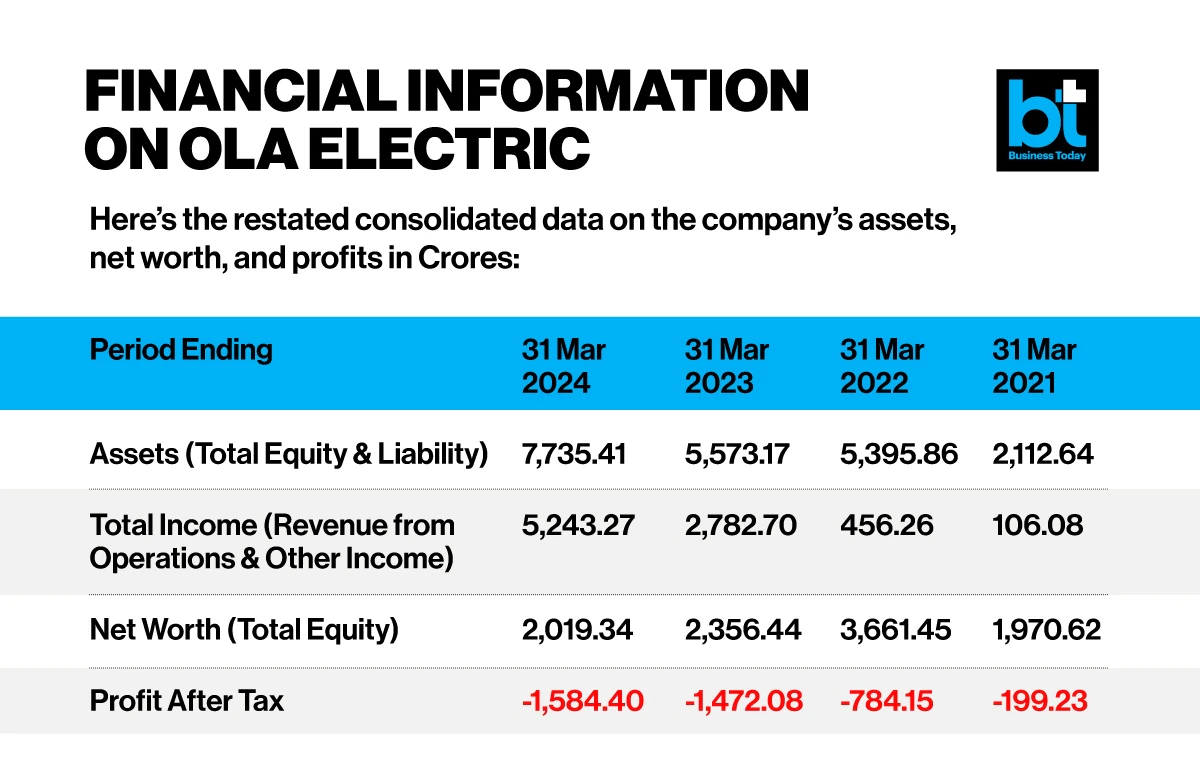

Retail investors have also shown considerable interest in Ola Electric's IPO. The shares were priced between ₹72 and ₹76 each, making them accessible to a broad range of investors. The stock rallied 75% post-IPO, surprising both traders and investors. This surge reflects the high level of confidence retail investors have in Ola Electric's future prospects.

The market reaction to Ola Electric's IPO has been overwhelmingly positive. The company's shares rose by 10%, reaching a 52-week high of ₹146, reflecting a 92% increase from its IPO price. This strong performance indicates that the market has high expectations for Ola Electric's growth and its impact on the broader EV ecosystem.

Ola Electric's IPO is poised to influence market dynamics significantly, marking a new era in India's EV market.

Metric | Value |

IPO Price Range | ₹72 - ₹76 |

Post-IPO Rally | 75% |

52-Week High | ₹146 |

Increase from IPO Price | 92% |

The positive market sentiment and strong investor response highlight the potential for Ola Electric to become a major player in the Indian EV market.

Utilization of IPO Funds

Ola Electric plans to use a significant portion of the IPO funds to expand its manufacturing capabilities. This includes increasing the capacity of its existing plants and setting up new facilities. The goal is to meet the growing demand for electric scooters in India and abroad.

A substantial amount of the funds will be allocated to research and development. This investment aims to drive innovation in electric vehicle technology, improve battery efficiency, and develop new features that enhance the user experience.

Ola Electric also intends to diversify its product offerings. The company is looking to introduce new product lines, including electric bikes and possibly electric cars, to capture a larger market share in the EV sector.

The IPO aims to raise approximately ₹6,000 crore, which will be utilized for various purposes, including expanding manufacturing capabilities, investing in research and development, and launching new product lines.

Ola Electric's Competitive Position

Market Share and Growth

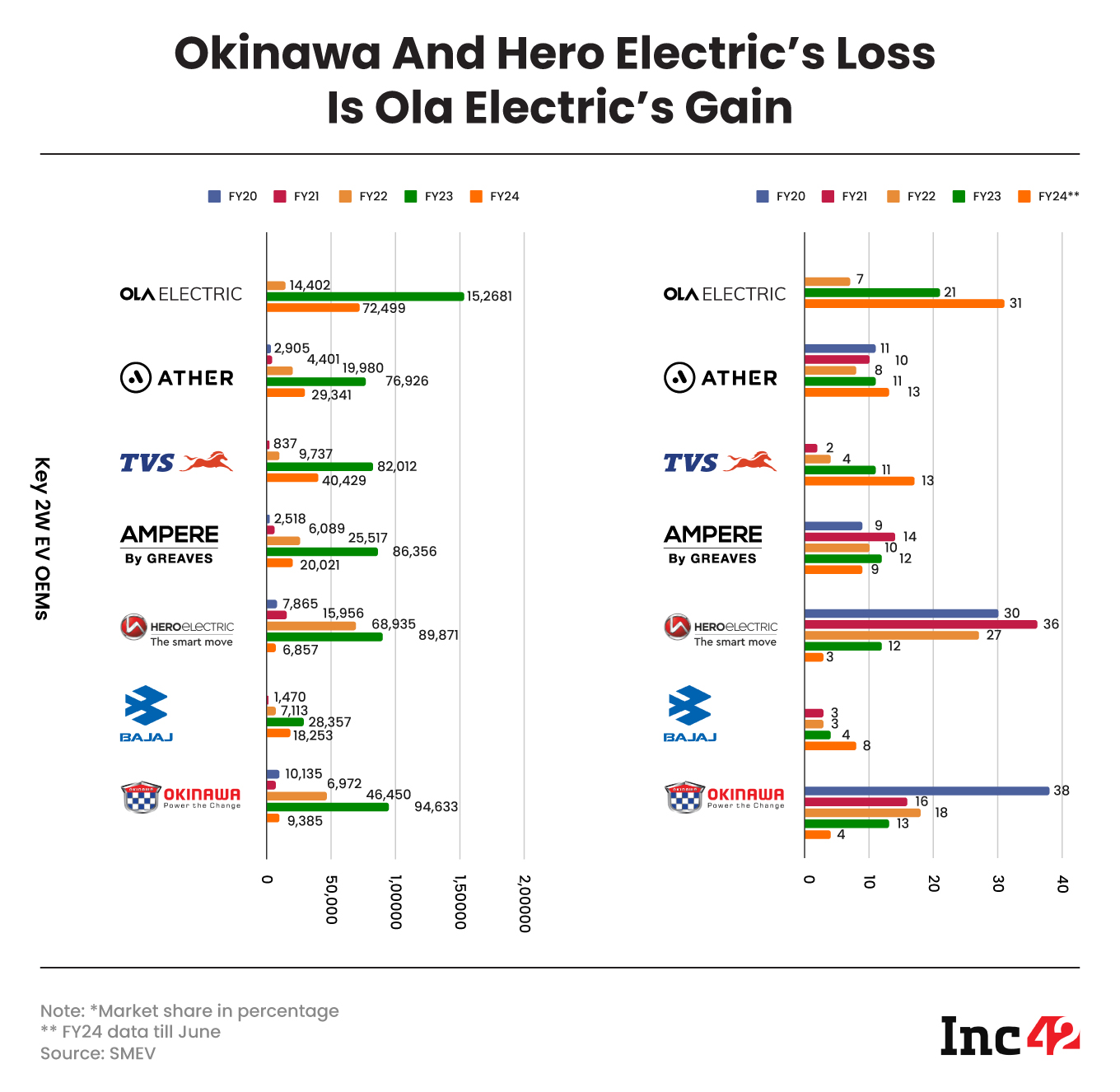

Ola Electric has seen a remarkable rise in its market share, growing from just 0.33% in FY2022 to an impressive 39.52% in Q3 FY2024. This growth is largely due to its aggressive marketing strategy and the introduction of multiple products.

The company sold 84,161 e-scooters in the latest quarter, a 67.9% year-over-year growth. This success is attributed to the expansion of its product range, which now includes the S1 Pro, S1 Air, and S1 X models, priced between Rs 1,29,999 and Rs 79,999.

Technological Innovations

Ola Electric is at the forefront of technological advancements in the EV sector. The company has been focusing on developing cutting-edge technologies to enhance the performance and efficiency of its electric scooters. One of the key innovations is the 4680 lithium cell, which is expected to give Ola Electric a significant edge over its competitors. This focus on technology not only improves product quality but also helps in maintaining a competitive position in the market.

Sustainability Initiatives

Ola Electric is committed to sustainability and has implemented several initiatives to reduce its environmental impact. The company focuses on creating eco-friendly products and has adopted sustainable manufacturing practices. These efforts are in line with the global push towards green technologies and help Ola Electric stand out as a responsible and forward-thinking company.

Ola Electric's commitment to sustainability and innovation positions it as a leader in the rapidly growing EV market. The company's focus on quality and eco-friendly practices sets a benchmark for others to follow.

Challenges and Opportunities Ahead

Regulatory and Policy Environment

Navigating the regulatory landscape in India can be complex for Ola Electric. The government has been supportive of electric vehicles (EVs), but policies can change, creating uncertainty. Compliance with evolving regulations is crucial for sustained growth.

Competition in the EV Market

Ola Electric faces stiff competition from both local and international players. Companies like Ather Energy and Bajaj Auto are also vying for market share. Staying ahead requires continuous innovation and understanding market needs.

Future Prospects and Strategies

The future looks promising for Ola Electric, with a growing demand for EVs in India. The company plans to expand its product line and enhance its manufacturing capabilities. Strategic partnerships and investments in research and development will be key to maintaining a competitive edge.

Ola Electric's journey is a testament to the challenges and rewards of entrepreneurship. The company's ability to adapt and innovate will determine its success in the evolving EV market.

Impact on the Broader EV Ecosystem

Boost to Local Manufacturing

Ola Electric's IPO is expected to significantly boost local manufacturing. By raising substantial funds, the company can invest in expanding its production facilities. This will not only create jobs but also enhance the overall manufacturing capabilities in India. The increased production capacity will help meet the growing demand for electric vehicles (EVs) in the country.

Influence on Other Auto Manufacturers

The success of Ola Electric's IPO is likely to have a ripple effect on other auto manufacturers. Companies that have been hesitant to enter the EV market may now see the potential and start investing in electric mobility. This could lead to a more competitive market, driving innovation and better products for consumers.

Contribution to Green Technologies

Ola Electric's commitment to sustainability goes beyond just producing electric scooters. The funds raised from the IPO will be used to invest in green technologies, such as advanced battery systems and renewable energy sources. This will not only reduce the carbon footprint of their products but also contribute to the broader goal of environmental conservation.

The IPO marks a pivotal moment for the EV industry in India, setting the stage for a greener and more sustainable future.

Conclusion

Ola Electric's IPO is a significant milestone for India's electric vehicle market. Raising Rs 6,000 crore, it stands as the largest auto IPO since Maruti Suzuki. This event not only highlights the growing interest in electric mobility but also marks a pivotal moment in the country's automotive industry.

With the funds, Ola Electric plans to expand its production and enhance its technology, positioning itself as a leader in the EV sector. The success of this IPO is a testament to the company's innovative approach and the increasing demand for sustainable transportation solutions in India.

At PIF Capital, we fast-track investors, SMEs, and business owners with the power to earn higher profits through IPO (initial public offering).

Jonathan Por; our Founder and Chairman of PIF Capital is a serial entrepreneur with 30 years of experience. Throughout the years at PIF Capital, we have built an exclusive capital community with over 40,000 SME community members, and share formulas created by PIF Capital such as the CPTK(Capital, Professional, Talent, Keymanship) model, 3F(Friend, Family, Fans) model, and the ABC(A+ entrepreneur, Business model, Capital) model.

Frequently Asked Questions

What is Ola Electric's IPO all about?

Ola Electric's IPO is a major event where the company is offering shares to the public to raise money. It aims to gather around $734 million, mainly to boost its electric scooter production and technology.

Why is Ola Electric's IPO significant?

This IPO is the largest in India's auto sector since Maruti Suzuki's, making it a landmark event. It highlights the growing interest in electric vehicles and green technology in India.

How did investors respond to Ola Electric's IPO?

The response was very positive. The IPO was fully subscribed on the second day, with institutional investors like Nomura and Norges Bank showing strong interest.

What will Ola Electric do with the money raised from the IPO?

The funds will be used to expand its manufacturing capabilities, invest in research and development, and develop new electric scooter models.

How does Ola Electric compare to other companies in the EV market?

Ola Electric is a leader in India's electric scooter market, with a significant market share. Its focus on innovation and sustainability sets it apart from competitors like TVS, Bajaj, and Ather Energy.

What challenges does Ola Electric face?

Ola Electric faces challenges like regulatory hurdles, competition from other EV manufacturers, and the need to continuously innovate to stay ahead in the market.