Securing capital is vital for SMEs and businesses across different developmental phases. In today’s increasing demand for advanced technology, having capital is vital for any business's success and investors have been key to raising capital.

According to Statista, the total capital raised globally is projected to reach USD603.2 billion, while the total capital raised by businesses in Singapore is estimated to reach USD17.4 billion.

For capital entrepreneurs, the objective extends beyond mere financial support; it's about fostering an environment where equity attracts top-tier talent and fuels robust investments in technology, research and development (R&D), and the continual enhancement of products and services.

However, navigating the complexities of fundraising can be daunting, especially when misinformation abounds. This may lead you to delay fundraising or avoid it completely which can be detrimental, especially for the early-growth stage of businesses.

Debunking Myth & Revealing Truth

By debunking common myths and understanding the realities of fundraising, our goal at PIF Capital is to help entrepreneurs gain better clarity and be excited to raise funds for their companies.

Investors Only Want Sexy Business

Myth: Investors only go for biotech, technology and clean energy companies

Truth: Investors are looking at a variety of industries depending on their investment needs. Typically, these companies are widely marketed because they have a higher growth potential (and risk) in the business.

However, investors looking for safer returns may consider risk-free or high-dividend yield assets such as REITS (real estate investment trusts) or the healthcare sector.

IPO Is Too Much Work

Myth: IPOs are too time-consuming and complex

Truth: The process of going IPO is manageable given the right support and guidance from experienced advisors. While it's true that taking a company public involves meticulous preparation and adherence to regulatory frameworks, the process is manageable with proper planning and guidance.

At PIF Capital, with our right team and resources in place, navigating the IPO journey can be a strategic move that opens doors to capital markets, enhances visibility, and facilitates future growth opportunities for the company.

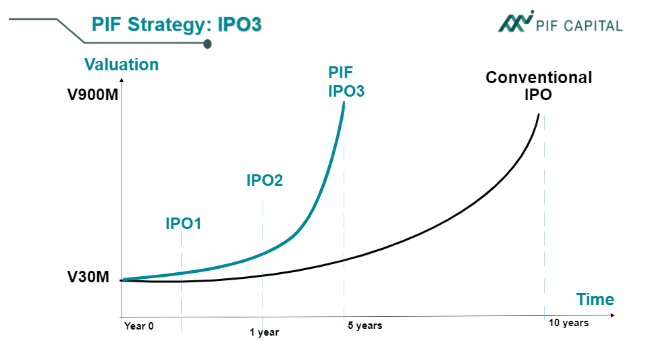

Typically, the process of pre-IPO and IPO takes a minimum of 10 years while we at PIF Capital IPO3 have a track record of getting businesses into IPO within just 5 years. This step could be further shortened, depending on a well-structured record thus making the underwriting process easier.

I Will Lose Ownership If I were to IPO

Myth: IPOs dilute ownership and control

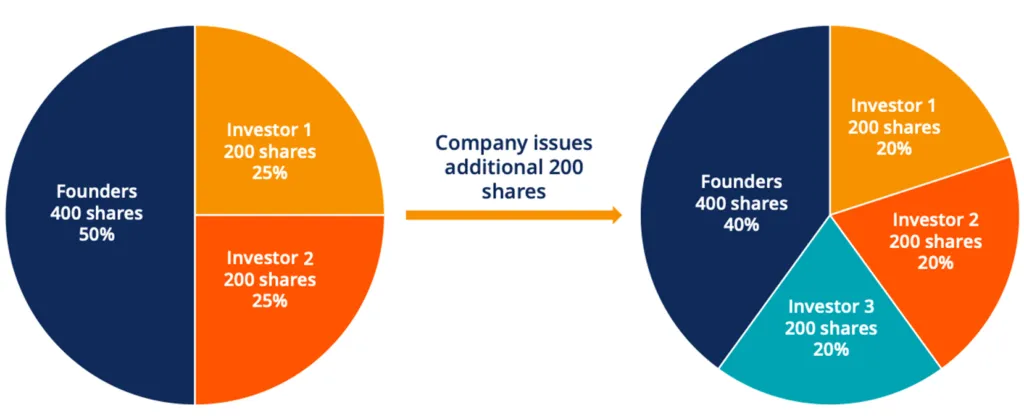

Truth: SME owners can still retain ownership during IPOs by structuring the offering and implementing proper governance mechanisms.

While selling shares to the public does dilute existing ownership to some extent, founders and existing shareholders can still retain significant control by maintaining majority ownership or utilising dual-class share structures. This means investors may have their shares diluted while founders maintain their equity percentage in the company.

IPO = Make Money

Myth: Success is guaranteed for companies after it is publicly listed

Truth: To thrive in the dynamic capital markets, a listed company must cultivate a robust long-term growth strategy. This is indispensable for sustaining investor confidence and fostering continual interest from existing and prospective investors in the company's prospects.

“Sell the dream!”

As Founders, our paramount objective is to maintain and deepen investor engagement, encouraging ongoing investment in our enterprise. By leveraging market insights and demonstrating adeptness in capital market utilisation, founders can effectively bolster their capital base over the long haul, ensuring long-term growth and prosperity.

IPOs Are For Businesses That Made It!

Myth: IPOs are only for profitable companies

Truth: Most investors are inclined to invest in SMEs, as long as they have a bankable business model and display growth potential. While some SMEs may be relatively small, they can still list their company on IPO via SPV (Special Purpose Vehicle) by working together with a holding company where assets can be merged and listed together.

For example, through a collaboration of 14 different companies under a holding company “Catalist” was able to raise a valuation of $38 million.

Should I IPO My Business?

Through IPO, SMEs and business owners may be able to build an additional source of income and also attract public investors to invest. This helps to raise business awareness and build more confidence in the business.

If you are looking to raise equity and IPO your business, be sure to join our weekly IPO3 conducted every Tuesday 9 am to 12 pm. This event is where entrepreneurs and SME owners gather to hear how we at PIF Capital help fundraise and get businesses to the next stage.

Register via this link to secure your seats:

https://pifcapital.sg/event/ipo3-english-18-june-2024-1382/register