Southeast Asia is emerging as a powerhouse for unicorns. They are privately held companies valued at $1 billion or more. Since 2023, the region has experienced an unprecedented influx of venture capital and angel investors to lead the rapid creation of these high-value startups.

As the financial hub of the Asia-Pacific, Singapore hosts 26 unicorns spanning various industries such as finance, insurance, and e-commerce. In 2022, Singapore housed 4,000 tech startups and over 400 venture capital managers. Notable unicorn startups include Carousell, Insider, and Carro.

The question: “Why are investors pooling into Southeast Asia, and how can I take advantage of this wave?”

At PIF Capital, we believe Singapore to be the next Silicon Valley where startups will likely thrive. For SME business owner, this is a golden opportunity to raise equity, expand their networks, and access a vibrant ecosystem of talent and resources.

Key Factors Driving Unicorn Growth in Southeast Asia

Private investors aren’t the only ones who have taken notice; governments around the world have recognized the value of nurturing their startup ecosystems as a pathway to economic growth and innovation.

Economic Growth and Digital Transformation

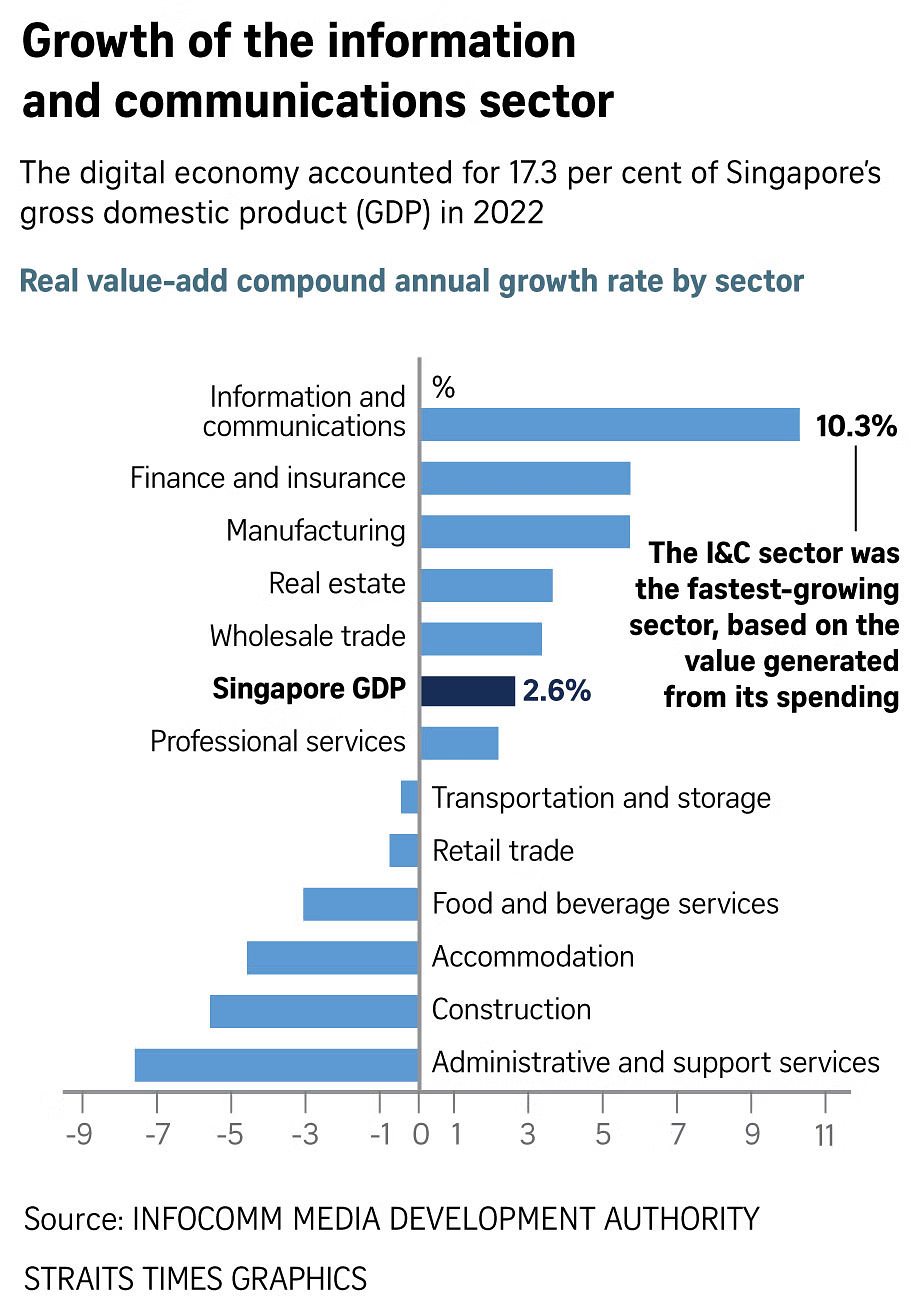

Photo taken from TheStraitsTimes on Singapore Economic growth distribution

Singapore has seen impressive economic growth over the past decade, positioning itself as a leading financial and technological hub in Southeast Asia. This prosperity has fostered a growing middle class with rising disposable incomes, driving consumer demand and entrepreneurial ventures. Digital transformation is central to this growth, with high internet penetration and smartphone usage across the city-state.

The digital economy in Singapore is expanding rapidly, with sectors such as e-commerce, fintech, and digital services witnessing significant growth. The COVID-19 pandemic further accelerated digital adoption, pushing businesses and consumers towards online platforms. This digital shift has opened up new opportunities for startups to innovate and scale quickly, laying the groundwork for unicorns to emerge.

And with remote work becoming the common norm in attracting talent, many countries are now offering “digital nomad visas” to attract these talents.

Government Policies and Support

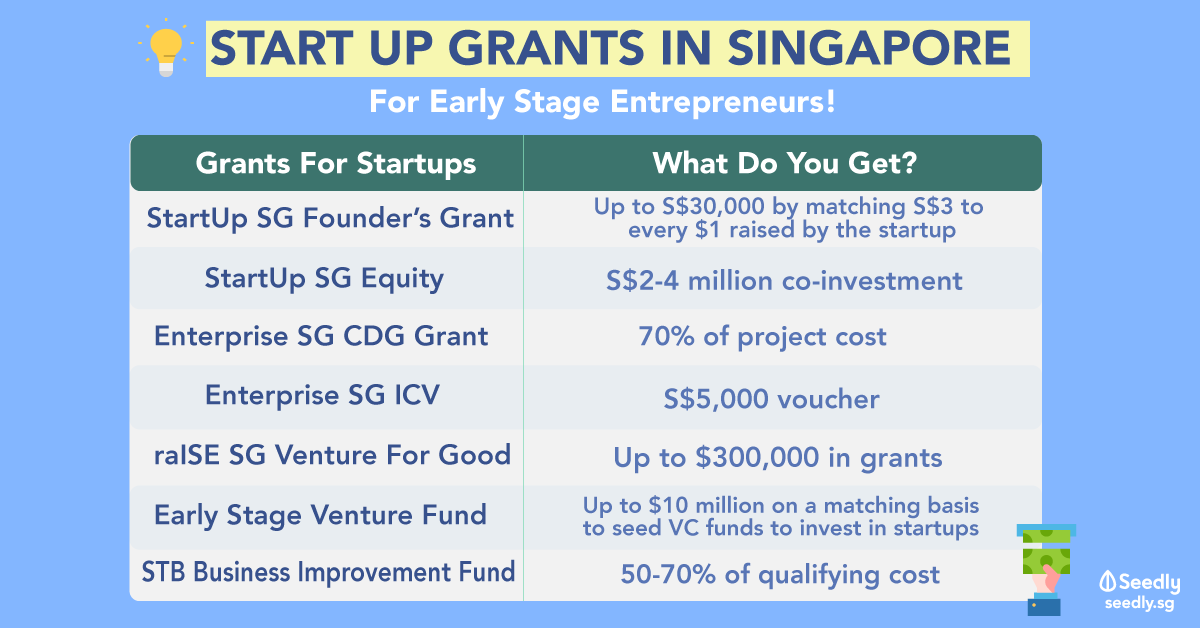

Photo taken from Seedly on Startup Grant

The Singaporean government has recognized the importance of fostering a robust startup ecosystem to drive economic growth and innovation. Initiatives such as the Startup SG program provide funding, mentorship, and resources to early-stage companies, creating a supportive environment for entrepreneurship. Additionally, policies like tax incentives and regulatory reforms reduce barriers to entry and encourage business growth.

These benefits meant that Singapore is the highest investor across Southeast Asia when it comes to promoting startup businesses. Government-backed institutions like Enterprise Singapore and SGInnovate play crucial roles in supporting startups through grants, networking opportunities, and access to global markets; providing up to $50,000 or 80% of qualifying cost.

These efforts are complemented by the establishment of tech hubs and innovation districts, which provide a conducive environment for startups to thrive. This proactive government support is essential in enabling startups to achieve unicorn status.

Increasing Investment and Venture Capital Interest

Photo taken from Medium on Top active VC firm in Singapore

The influx of investment and venture capital into Singapore has been a significant catalyst for the rise of unicorn startups.

In recent years, there has been a notable increase in venture capital firms, private equity investors, and corporate venture arms looking to capitalize on the city-state's high-growth potential.

Mega funding rounds and the presence of global investors like Sequoia Capital, SoftBank, and Tencent have provided the necessary capital for startups to scale rapidly. Local venture capital firms, such as Vertex Ventures and Golden Gate Ventures, also play a vital role, offering region-specific insights and support.

PIF Capital has also been instrumental in this investment landscape, providing crucial equity funding and strategic support to promising startups to over 30,000 SME owners, 10,000 partner member and over 200 consultancy clients.

Jonathan Por; our Founder and Chairman of PIF Capital is a serial entrepreneur with 30 years of experience. Throughout the years at PIF Capital, we have built an exclusive capital community with over 40,000 SME community members, and share formulas created by PIF Capital such as the CPTK(Capital, Professional, Talent, Keymanship) model, 3F(Friend, Family, Fans) model, and the ABC(A+ entrepreneur, Business model, Capital) model.

If you are interested in understanding more about how to make your business sexy, bankable, and destructive, then reach out to us at PIF Capital events page.

By connecting startups with a network of investors and offering tailored financial solutions, PIF Capital helps fast-track their growth trajectory. This robust investment environment ensures that more startups have the resources they need to innovate, expand, and eventually achieve unicorn status.

Southeast Asia as a Global Innovation Hub

![]()

As Southeast Asia continues to attract record investments and foster entrepreneurial talent, it is poised to play a pivotal role in the global innovation landscape. The democratization of opportunities for startup success, driven by data-driven investment strategies and a thriving digital economy, heralds a promising future for the region and beyond.

For startups to get ahead of their competitors, being able to raise equity funding is crucial for business development, hiring talent, and R&D.

Jonathan Por; our Founder and Chairman of PIF Capital is a serial entrepreneur with 30 years of experience. Throughout the years at PIF Capital, we have built an exclusive capital community with over 40,000 SME community members, and share formulas created by PIF Capital such as the CPTK(Capital, Professional, Talent, Keymanship) model, 3F(Friend, Family, Fans) model, and the ABC(A+ entrepreneur, Business model, Capital) model.

If you are interested in understanding more about how to make your business sexy, bankable, and destructive, then reach out to us at PIF Capital events page.

For unicorns to reach their maximum potential and become global brands, going public is crucial as it provides unlimited capital for scaling businesses. Investor dollars flow toward businesses with innovative, disruptive, and scalable models due to their high growth potential.

At PIF Capital, we fast-track investors, SMEs, and business owners with the power to earn higher profits through IPO (initial public offering). If you are interested in understanding more about how to make your business sexy, bankable, and destructive, then reach out to us at PIF Capital.

Frequently Asked Questions

What is a unicorn company?

A unicorn company is a privately held startup that is valued at $1 billion or more.

How many unicorns were created in Southeast Asia in 2021?

In 2021, Southeast Asia minted 17 unicorns.

What sectors are driving the growth of unicorns in Southeast Asia?

Key sectors driving growth include fintech, logistics, and super-apps.

How has venture capital impacted the rise of unicorns in Southeast Asia?

Venture capital has flooded the region, leading to record-breaking investments and the rapid creation of unicorns.

What role do global institutions play in Southeast Asia's innovation ecosystem?

Global institutions collaborate with Southeast Asian entities through webinars, conferences, and joint research, enhancing the region's innovation ecosystem.

What is the future outlook for unicorns in Southeast Asia?

The future looks promising with predicted growth trajectories, though challenges such as regulatory environments and market competition remain.

How PIF Capital help company to raise equity?

PIF Capital enables different investors to come together and pool their capital to undertake a specific project or investment approach that they would not undertake alone