Wilmar International Limited has emerged as a powerhouse in the agribusiness sector, particularly in Asia. With a market capitalisation of SGD19.68 billion, the company has made significant strides since its inception. This article explores its history, business model, strategic moves, financial performance, challenges, and its vital role in global agribusiness.

Key Takeaways

- Wilmar International was founded in 1991 and has grown rapidly in the agribusiness sector.

- The company uses an integrated model that combines various parts of the supply chain, from farming to processing.

- Strategic partnerships and acquisitions have helped Wilmar strengthen its market position.

- In FY2023, Wilmar reported impressive financial results, showcasing its growth and stability.

- The company faces challenges like competition and regulations but has plans for future growth.

Wilmar International Limited: A Brief History

Wilmar International Limited was founded in 1991 in Singapore. Initially, it started as a trading company focused on palm oil. Over the years, it grew rapidly, establishing itself as a key player in the agribusiness sector.

Wilmar has achieved several significant milestones:

- 1991: Founded as a palm oil trading company.

- 2006: Changed its name from Ezyhealth Asia Pacific Ltd to Wilmar International Limited.

- 2010: Became the largest palm oil producer in the world.

The company has expanded its operations across Asia and beyond. Today, it operates in over 30 countries and has a diverse portfolio that includes food products, feed, and biofuels. Wilmar's growth strategy has been driven by both organic growth and strategic acquisitions, making it a leader in the agribusiness industry.

Wilmar International Limited is now recognised as Asia's leading agribusiness group, with a market capitalisation of SGD19.68 billion.

Year | Milestone |

1991 | Founded |

2006 | Name Change |

2010 | Largest Palm Oil Producer |

2023 | Market Cap SGD19.68 Billion |

The Business Model of Wilmar International Limited

Wilmar International Limited operates on a fully integrated agribusiness model. This means they manage every step of the supply chain, from farming to processing and distribution. This integration helps them control costs and ensure quality.

Key Business Segments

Wilmar's operations are divided into several key segments:

- Oilseed Crushing: Processing oilseeds into edible oils.

- Consumer Products: Producing and selling branded food products.

- Sugar Milling: Processing sugarcane into sugar.

- Plantation: Cultivating palm oil and other crops.

Segment | Description | Contribution to Revenue |

Oilseed Crushing | Processing oilseeds | 30% |

Consumer Products | Branded food products | 25% |

Sugar Milling | Sugar production | 20% |

Plantation | Cultivation of palm oil | 25% |

Sustainability & Corporate Responsibility

Wilmar is committed to sustainability which focuses on:

- Reducing environmental impact.

- Supporting local communities.

- Ensuring ethical sourcing of raw materials.

Wilmar believes that sustainability is key to long-term success in the agribusiness sector.

This approach not only enhances their brand image but also meets the growing demand for responsible business practices in the global market.

Strategic Acquisitions and Joint Ventures

Wilmar International Limited has formed a significant partnership with Olam International, enhancing its market reach and operational capabilities. This collaboration allows both companies to leverage their strengths in the agribusiness sector, creating a more robust supply chain.

Major Acquisitions

Wilmar has made several strategic acquisitions to bolster its position in the market. Notable acquisitions include:

- Adani Wilmar, focuses on expanding its FMCG segment, setting aside $1 billion for purchasing brands in spices and packaged foods.

- The acquisition of various local companies to enhance its product offerings and market penetration.

Year | Acquisition | Purpose |

2021 | Adani Wilmar | FMCG Expansion |

2020 | Local Brands | Market Penetration |

Impact on Market Position

These strategic moves have significantly impacted Wilmar's market position. By expanding its portfolio and enhancing its operational efficiency, Wilmar has solidified its status as a leader in the agribusiness sector. This growth strategy not only increases revenue but also strengthens its competitive edge in a rapidly evolving market.

Wilmar's strategic acquisitions and partnerships are crucial for maintaining its leadership in the agribusiness landscape, ensuring sustainable growth and innovation.

Financial Performance and Market Capitalization

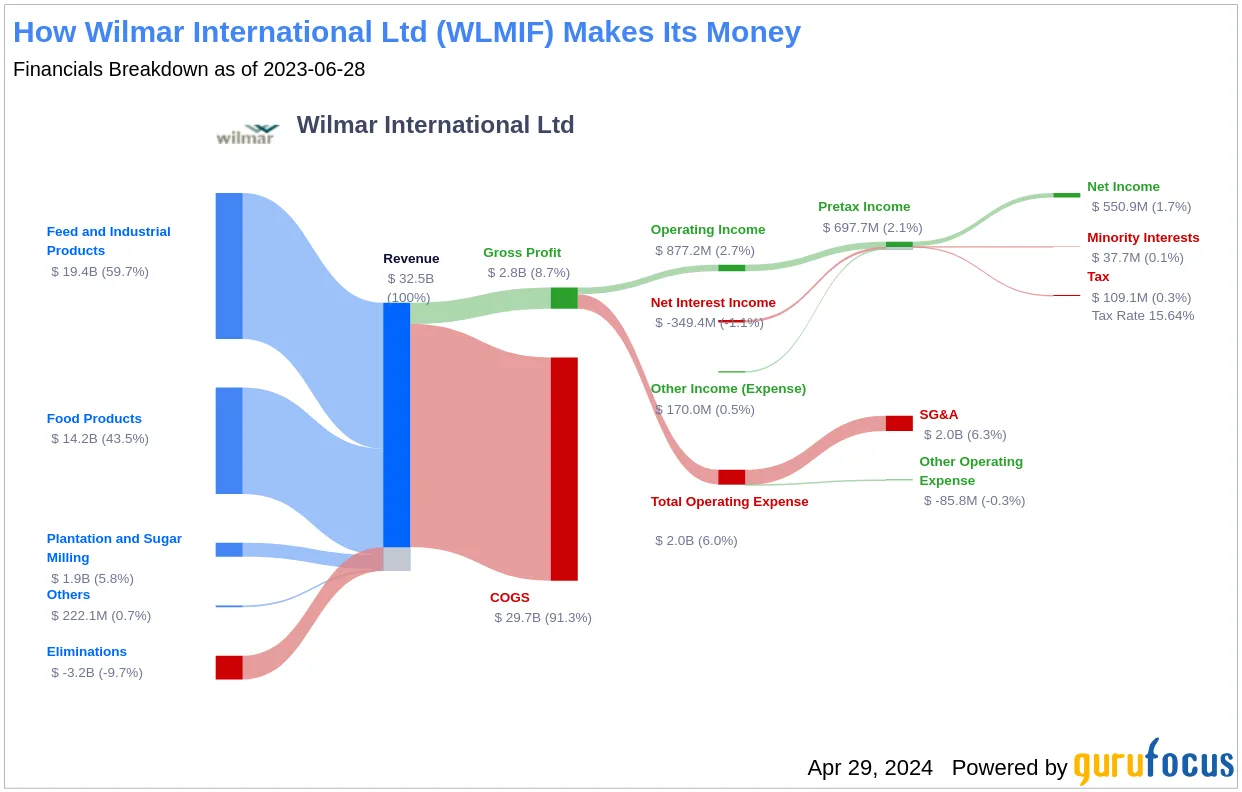

In the financial year 2023, Wilmar International Limited reported impressive results, achieving a revenue of approximately 67 billion US dollars. This significant figure showcases the company's robust performance in the agribusiness sector.

Market Capitalization Growth

As of now, Wilmar's market capitalization stands at SGD 19.68 billion. This growth reflects the company's strong position in the market and its ability to adapt to changing economic conditions.

Year | Market Capitalization (SGD Billion) |

2021 | 15.00 |

2022 | 17.50 |

2023 | 19.68 |

Core Net Profit Analysis

In the first half of 2024, Wilmar achieved a core net profit of US$606 million, which is 5% higher than the same period in 2023. This growth is attributed to strong performance in food products and feed & industrial products.

Wilmar's consistent financial performance highlights its strategic focus and operational efficiency in a competitive market.

Overall, Wilmar International Limited continues to demonstrate strong financial health and market presence, positioning itself as a leader in the agribusiness industry.

Challenges and Future Prospects

Wilmar International Limited faces various regulatory hurdles that can impact its operations. These include:

- Compliance with local and international laws.

- Adapting to changing environmental regulations.

- Managing sustainability practices to meet consumer expectations.

The agribusiness sector is highly competitive. Wilmar must navigate:

- Emerging competitors in Asia.

- Price fluctuations in raw materials.

- Innovations from rival companies that could disrupt the market.

To maintain its leading position, Wilmar is focusing on:

- Expanding its market presence in emerging economies.

- Investing in technology to improve efficiency.

- Strengthening partnerships and joint ventures to enhance its supply chain.

The future of Wilmar International Limited hinges on its ability to adapt to challenges while seizing new opportunities in the agribusiness landscape.

Wilmar's Role in the Global Agribusiness Landscape

Wilmar International Limited is a major player in the agribusiness sector across Asia. With a strong foothold in the region, it operates in various countries, ensuring a steady supply of agricultural products. The company’s extensive network allows it to reach diverse markets effectively.

Global Supply Chain Integration

Wilmar has developed a robust supply chain that integrates various stages of production. This includes:

- Sourcing raw materials from farmers and suppliers.

- Processing these materials into finished products.

- Distribution to retailers and consumers.

This integrated approach helps Wilmar maintain quality and efficiency throughout its operations.

Contribution to Global Food Security

Wilmar plays a crucial role in ensuring food security worldwide. By investing in sustainable practices and innovative technologies, the company aims to:

- Increase agricultural productivity.

- Reduce waste in the supply chain.

- Support local farmers through fair trade practices.

Wilmar's commitment to sustainability not only benefits the environment but also enhances food availability for communities globally.

In summary, Wilmar International Limited stands out as a leader in the agribusiness landscape, leveraging its integrated model to address challenges and contribute positively to food security.

Conclusion

In summary, Wilmar International Limited has emerged as a powerhouse in Asia's agribusiness sector, boasting a market value of SGD19.68 billion. Its journey reflects not just growth but also a commitment to sustainability and innovation.

By focusing on various aspects of the supply chain, from farming to distribution, Wilmar has positioned itself as a leader in the industry. As it continues to expand and adapt to changing market demands, the company is set to play a crucial role in meeting the food needs of a growing population. The future looks bright for Wilmar, and its impact on the agribusiness landscape will likely be significant.

Frequently Asked Questions

What is Wilmar International Limited?

Wilmar International Limited is a major agribusiness company based in Asia. It focuses on producing and trading food products, including palm oil, sugar, and grains.

When was Wilmar founded?

Wilmar was founded in 1991. It started as a palm oil trading company and has since grown into one of the largest agribusiness groups in Asia.

What are the main products of Wilmar?

Wilmar produces a variety of products like edible oils, sugar, grains, and animal feed. They play a big role in the food supply chain.

How does Wilmar ensure sustainability?

Wilmar is committed to sustainable practices. They work to reduce their environmental impact and promote responsible farming and sourcing.

What is Wilmar's market capitalization?

As of now, Wilmar has a market capitalization of SGD19.68 billion, making it one of the leading agribusiness companies in Asia.

What are some challenges Wilmar faces?

Wilmar faces challenges such as regulatory issues, environmental concerns, and competition in the market. They are constantly working on strategies to overcome these challenges.