Small and medium-sized enterprises (SMEs) often seek ways to grow and expand. One powerful strategy is leveraging capital markets for mergers and acquisitions (M&A). This approach can help SMEs boost their market presence, gain new customers, and improve their overall business. However, navigating the M&A landscape requires careful planning and understanding of various factors.

Key Takeaways

- Capital markets offer SMEs a way to grow quickly through M&A.

- Strategic planning is crucial for successful M&A initiatives.

- Financial health assessment helps in securing necessary funding.

- Understanding local laws and compliance is vital to avoid legal issues.

- Post-M&A cultural integration is key to building a unified company.

Understanding the Role of Capital Markets in SME Growth

Capital markets are places where people buy and sell financial products like stocks and bonds. These markets help businesses get the money they need to grow. For small and medium-sized enterprises (SMEs), capital markets can be a great way to find new funds.

Benefits for SMEs

Using capital markets can help SMEs in many ways:

- Access to more money: SMEs can get funds without taking on too much debt.

- Growth opportunities: With more money, SMEs can expand their businesses.

- Better visibility: Being part of the capital market can make an SME more well-known.

Key Considerations

Before joining capital markets, SMEs should think about:

- Costs: There are fees to join and stay in the market.

- Rules: SMEs must follow strict rules to be part of the market.

- Market conditions: The market can go up and down, which can be risky.

By understanding these factors, SMEs can make better choices about using capital markets for growth.

Strategic Planning for M&A Success

Strategic planning is a cornerstone of M&A success, encompassing market analysis, synergy identification, and post-merger integration strategies. Companies embarking on M&A activities must align their strategic objectives, evaluate market dynamics, and identify potential synergies that can drive growth and efficiency. Moreover, developing a robust integration plan that addresses operational, financial, and cultural aspects is crucial for seamless execution.

Setting Clear Objectives

Setting clear objectives is the first step in strategic planning for M&A. Companies need to define what they aim to achieve through the merger or acquisition. This could include expanding market share, acquiring new technologies, or entering new markets. Clear objectives provide a roadmap for the entire M&A process, ensuring that all efforts are aligned towards common goals.

Identifying Potential Targets

Identifying potential targets involves thorough market research and analysis. Companies should look for targets that align with their strategic objectives and offer potential synergies. This process includes evaluating the financial health, market position, and cultural fit of potential targets. A well-defined criteria list can streamline the identification process and ensure that only the most suitable candidates are considered.

Aligning with Market Trends

Aligning with market trends is essential for the success of any M&A activity. Companies must stay informed about industry trends, competitive dynamics, and regulatory changes. This knowledge helps in identifying opportunities and threats, allowing companies to make informed decisions. Staying ahead of market trends can provide a competitive edge, making the M&A process more effective and successful.

Financial Preparation for M&A

Assessing Financial Health

Before diving into a merger or acquisition, it's crucial to evaluate the financial health of your business. This involves reviewing your balance sheets, income statements, and cash flow statements. Strong financial health ensures that your company can handle the complexities of M&A transactions.

Securing Funding

M&A financing is the process through which companies fund their mergers and acquisitions. Most M&A transactions involve considerable amounts of capital, so securing the right funding is essential. Options include bank loans, private equity, and issuing new shares. Each option has its pros and cons, and the choice depends on your company's specific needs and circumstances.

Cost-Benefit Analysis

Conducting a cost-benefit analysis helps in understanding the potential gains and expenses associated with the M&A. This analysis should cover both tangible and intangible benefits, such as increased market share and improved brand value. A thorough cost-benefit analysis can guide decision-making and ensure that the M&A will be beneficial in the long run.

Financial preparation is the backbone of any successful M&A. Without it, even the best strategic plans can fall apart.

Financial Aspect | Importance |

Balance Sheets | Assess financial stability |

Income Statements | Evaluate profitability |

Cash Flow Statements | Ensure liquidity |

Funding Options | Secure necessary capital |

Cost-Benefit Analysis | Guide decision-making |

Navigating Legal and Regulatory Challenges

Understanding Local Laws

When engaging in M&A activities, it's crucial for SMEs to understand the local laws of the regions they are operating in. This includes knowing the legal requirements for mergers and acquisitions, which can vary significantly from one jurisdiction to another. Failing to comply with local laws can result in severe penalties and can jeopardise the entire M&A process.

Compliance Requirements

SMEs must ensure they meet all compliance requirements during an M&A transaction. This involves adhering to industry-specific regulations, financial reporting standards, and other legal obligations. A thorough compliance check can help avoid legal issues and ensure a smooth transaction.

Risk Mitigation

Risk mitigation is a key aspect of navigating legal and regulatory challenges. SMEs should conduct a comprehensive risk assessment to identify potential legal and regulatory risks. This can include:

- Conducting thorough due diligence

- Seeking advice from legal experts

- Implementing robust compliance programmes

By proactively addressing these challenges, SMEs can navigate the complexities of M&A with greater confidence and success.

Cultural Integration Post-M&A

One of the critical challenges in M&A transactions is the integration of company cultures. Cultural differences can impede collaboration, communication, and employee engagement. Successful cultural integration requires a thoughtful approach that acknowledges the unique identity of each organisation while fostering a shared set of values, norms, and behaviours. Companies must invest in cultural assessments, leadership alignment, and employee engagement initiatives to bridge cultural gaps and build a cohesive environment.

Successfully integrating acquired companies requires sensitivity to cultural differences and effective talent management strategies. SMEs must prioritise cultural integration initiatives, provide cross-cultural training, and foster a supportive environment to retain key talent and drive synergy realisation. Developing intercultural communication skills and adapting approaches to align with local business practises and cultural norms are essential steps.

Cultural fit is critical to the success of an integration, according to 95 percent of executives in a McKinsey survey. Poor cultural cohesion can have a detrimental effect on retention rates. If a company retains more than half of the new talent three years after an acquisition, it is considered a success. Building a unified company culture involves developing a clear integration plan and investing in building trust and rapport with the acquired company's employees.

Leveraging Digital Tools for M&A

Digital tools have revolutionised the due diligence process in M&A. By leveraging digitalisation, M&A professionals can conduct thorough background checks, verify financial capabilities, and assess the seriousness of both parties involved. This speeds up the process and reduces errors.

Technology Integration

M&A teams have a plethora of platform tools to choose from, like virtual data rooms and project management software, in order to help them manage deals more efficiently. These tools streamline communication, document sharing, and task management, making the entire process smoother.

Data-Driven Decision Making

Data-driven marketing consultation can boost online presence and help in making informed decisions. By analysing data, companies can identify trends, predict outcomes, and make strategic choices that align with their goals. This approach ensures that decisions are based on solid evidence rather than gut feeling.

Leveraging digital tools in M&A not only enhances efficiency but also provides a competitive edge in the market.

Case Studies of Successful SME M&As

Facebook's acquisition of WhatsApp is a prime example of a successful M&A. This deal allowed Facebook to expand its user base significantly. The acquisition was valued at $19 billion, making it one of the largest tech deals in history. The strategic move helped Facebook to dominate the messaging app market, leveraging WhatsApp's vast user network.

Local SMEs have also seen success through M&A. For instance, a small tech company merged with a local software firm to enhance its product offerings. This merger allowed both companies to pool their resources and expertise, resulting in a stronger market position. The combined entity was able to attract more clients and increase its revenue.

From these case studies, several lessons can be drawn:

- Clear Objectives: Having well-defined goals is crucial for M&A success.

- Due Diligence: Thoroughly investigating the target company can prevent future issues.

- Cultural Integration: Ensuring a smooth cultural fit can enhance post-merger performance.

M&A can be a powerful tool for growth, but it requires careful planning and execution to be successful.

Challenges and Risks in M&A for SMEs

Mergers and acquisitions (M&A) can be a powerful tool for small and medium-sized enterprises (SMEs) looking to expand their reach and unlock new growth potential. However, navigating the complexities of M&A requires careful consideration of both the promising opportunities and potential risks involved.

Maximising Value from M&A

Post-M&A integration is crucial for realising the full potential of a merger or acquisition. Effective communication and a clear plan can help align the goals of both companies. This phase involves combining operations, systems, and cultures to create a unified entity.

To measure the success of an M&A, companies should establish key performance indicators (KPIs). These metrics can include financial performance, customer retention, and employee satisfaction. Regularly tracking these KPIs helps in identifying areas for improvement and ensuring the merger is on the right track.

Continuous improvement is essential for sustaining the benefits of an M&A. Companies should regularly review their strategies and operations to identify opportunities for enhancement. This can involve adopting new technologies, optimising processes, and fostering a culture of innovation.

By focusing on continuous improvement, companies can stay competitive and adapt to changing market conditions.

Exploring Emerging Markets for M&A Opportunities

Emerging markets (EMs) offer a wealth of opportunities for small and medium-sized enterprises (SMEs) looking to grow through mergers and acquisitions (M&A). These markets are often characterised by rapid economic growth, expanding middle classes, and increasing disposable incomes. This creates a fertile ground for SMEs to expand their reach and boost revenue. However, entering these markets requires careful planning and strategic execution.

Building a Strong M&A Team

Key Roles and Responsibilities

A successful M&A team needs a mix of skills and expertise. Key roles include financial analysts, legal advisors, and strategic planners. Each member brings unique insights to the table, ensuring a well-rounded approach to mergers and acquisitions.

Selecting Advisors

Choosing the right advisors is crucial. Look for those with a proven track record in M&A. They should understand the nuances of the process and be able to guide you through complex decisions. This is particularly advantageous in sectors where building these capabilities organically would be time-consuming or challenging.

Team Collaboration

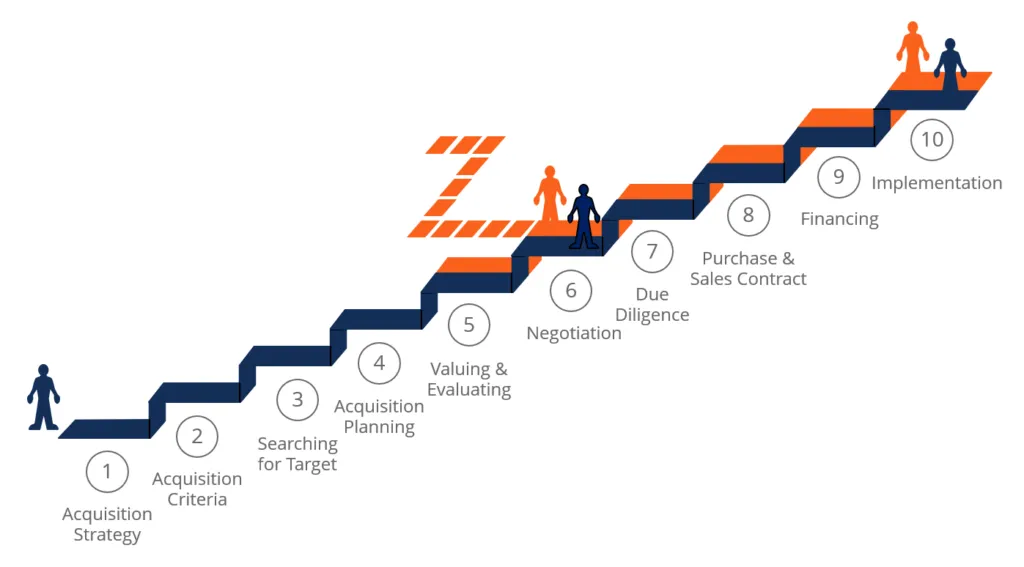

Effective communication and collaboration are vital. Regular meetings and clear communication channels help keep everyone on the same page. Develop an acquisition strategy: begin by strategizing how to pursue an acquisition. Define your goals for acquiring another company, considering current market trends and your long-term objectives.

A well-coordinated team can navigate the complexities of M&A more efficiently, reducing risks and increasing the chances of success.

Creating a strong M&A team is crucial for any business looking to grow through mergers and acquisitions. At VentureStudio, we understand the importance of having the right people in place to ensure success. Our team of experts is dedicated to helping you build a team that can navigate the complexities of M&A with ease. Visit our website to learn more about how we can help you achieve your business goals.

Conclusion

In conclusion, SMEs have a unique opportunity to grow by using mergers and acquisitions. By carefully planning and understanding the risks, they can enter new markets and expand their reach. Just like Facebook did with WhatsApp, SMEs can find new ways to grow and succeed. It's important for SMEs to see M&A as a tool for growth, not just something for big companies.

At PIF Capital, we fast-track investors, SMEs, and business owners with the power to earn higher profits through IPO (initial public offering).

Jonathan Por; our Founder and Chairman of PIF Capital is a serial entrepreneur with 30 years of experience. Throughout the years at PIF Capital, we have built an exclusive capital community with over 40,000 SME community members, and share formulas created by PIF Capital such as the CPTK(Capital, Professional, Talent, Keymanship) model, 3F(Friend, Family, Fans) model, and the ABC(A+ entrepreneur, Business model, Capital) model.

If you are interested in understanding more about how to make your business sexy, bankable, and destructive, then reach out to us at PIF Capital events page.

Frequently Asked Questions

What are capital markets?

Capital markets are places where people buy and sell financial products like stocks and bonds. They help businesses get money to grow.

How can capital markets benefit SMEs?

Capital markets can give SMEs the money they need to grow, buy other companies, and make more profit. They also help SMEs reach new customers and markets.

What should SMEs consider before using capital markets?

SMEs should think about their goals, the risks, and the costs. They should also make sure they understand the market and have a solid plan.

Why is strategic planning important for M&A success?

Strategic planning helps SMEs set clear goals, find the right companies to buy, and stay in line with market trends. It makes the whole process smoother.

How can SMEs prepare financially for M&A?

SMEs should check their financial health, secure enough funding, and do a cost-benefit analysis to make sure the deal is worth it.

What legal challenges can SMEs face in M&A?

SMEs might have to deal with different local laws, compliance requirements, and risks. Understanding these can help avoid problems.

How important is cultural integration after an M&A?

Cultural integration is very important. It helps manage differences, integrate employees, and build a unified company culture.

What digital tools can help in M&A?

Digital tools like data analytics and technology integration can help with due diligence, making better decisions, and ensuring a smooth transition.