Visa's rise to the top of the financial world is an inspiring tale of growth and innovation. Starting as a small credit card program, Visa transformed into a global leader in digital payments.

With now over 200 countries connecting millions of consumers and merchants worldwide. This article dives into Visa's history, its major milestones, and its continuous drive to innovate. By the end of this article, you'll learn how to top MNCs use M&A to fast-track their business growth.

Key Takeaways

- Visa began as BankAmericard in 1958 and rebranded to Visa in 1976.

- In 2008, Visa's IPO was the largest in U.S. history, raising $19.2 billion.

- Visa has expanded its services to over 200 countries, connecting millions of consumers and merchants.

- The company is investing $100 million in generative AI to drive future innovations.

- Visa is actively integrating digital currencies and forming partnerships with fintech startups.

The Origins of Visa

Visa's journey began in 1958 when Bank of America introduced the first consumer credit card, known as BankAmericard. This card was revolutionary because it featured a "revolving credit" option, allowing users to carry a balance from month to month. This innovation laid the groundwork for the modern credit card industry.

Early Expansion and Innovations

In 1974, BankAmericard expanded internationally, marking the start of Visa's global reach. Just a year later, in 1975, the company introduced the debit card, another significant milestone. These early innovations set the stage for Visa's future growth and dominance in the financial sector.

Formation of Visa Inc.

The year 2007 was pivotal for Visa as it marked the formation of Visa Inc. through the merger of several regional businesses worldwide. This restructuring was a strategic move to unify the brand and streamline operations. Visa Inc. was officially formed, setting the stage for its historic IPO in 2008.

Visa's Historic IPO and Corporate Restructuring

In October 2006, Visa announced a major reorganization of its businesses. This restructuring led to the creation of Visa Inc., a public company. The reorganisation involved merging Visa Canada, Visa International, and Visa USA into the newly formed Visa Inc.

At the same time, Visa's operations in Western Europe were separated into different entities, which were jointly owned by member banks. This restructuring was completed on October 3, 2007, marking the first step towards Visa's initial public offering (IPO).

Details of the 2008 IPO

On November 9, 2007, Visa Inc. submitted its IPO filing to raise $10 billion through the U.S. Securities and Exchange Commission (SEC). On February 25, 2008, Visa decided to proceed with an IPO for half of its shares.

The IPO took place on March 18, 2008, with Visa selling 406 million shares at $44 per share, exceeding the high end of the expected pricing range. This IPO raised $17.9 billion, making it the largest initial public offering in U.S. history at that time.

On March 20, 2008, the underwriters of the IPO exercised their overallotment option and acquired an additional 40.6 million shares, bringing the total number of Visa's IPO shares to 446.6 million and the total proceeds to $19.1 billion. Visa's stock is now traded on the New York Stock Exchange under the ticker symbol "V".

Impact on the Financial Markets

Visa's IPO had a significant impact on the financial markets. The company's stock price surged from $44 at its IPO to $256 today, meaning banks that retained some B shares have enjoyed a significant windfall. The successful IPO also demonstrated the strength and resilience of Visa as a financial giant, attracting investors and solidifying its position in the market. The restructuring and IPO allowed Visa to become more efficient and better positioned to innovate and address economic challenges, leading to its rise as a market leader.

Visa's Financial Performance

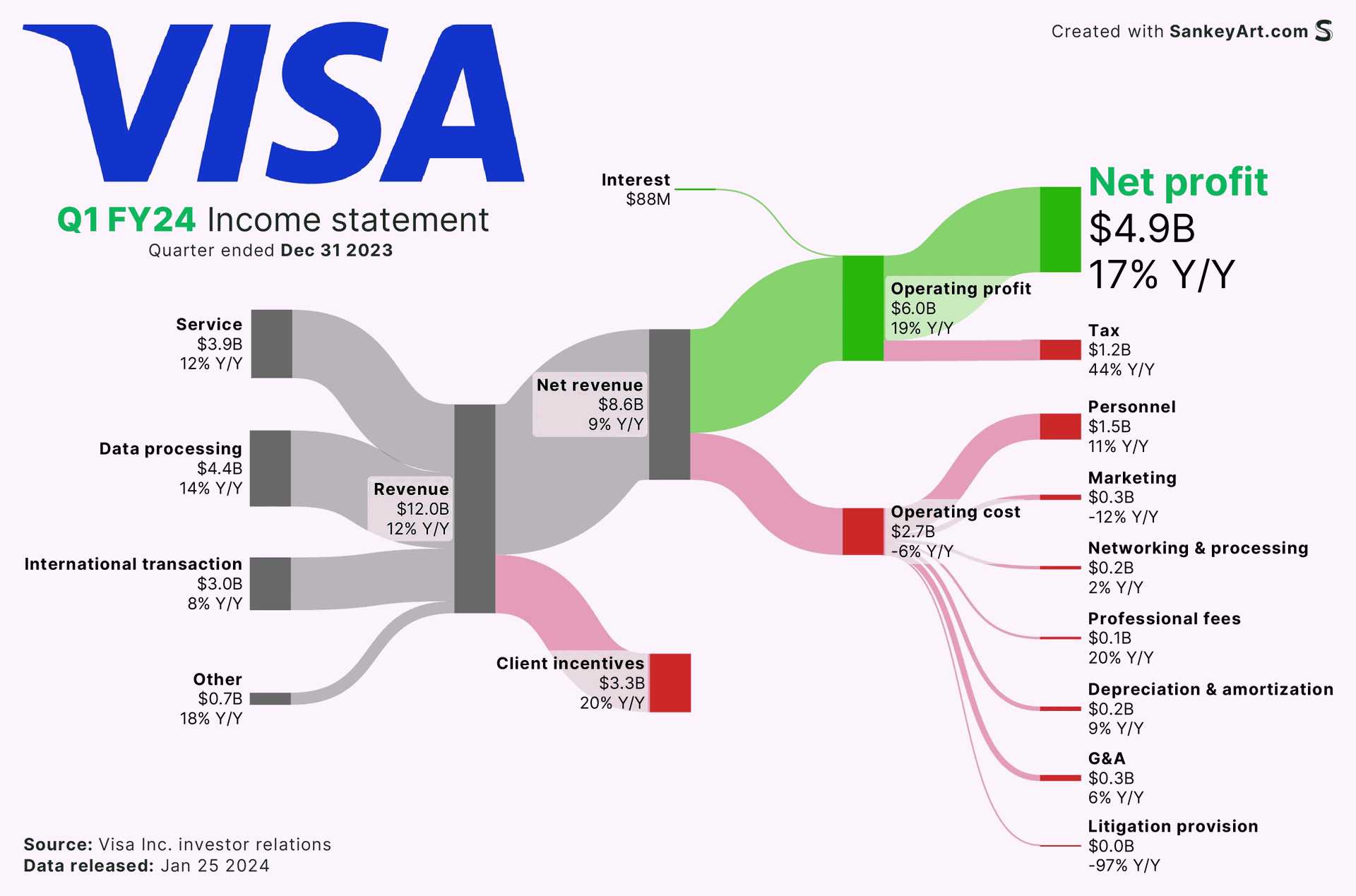

In fiscal year 2022, Visa reported impressive financial results. The company earned $14.96 billion and had an annual revenue of $29.31 billion. This was a 21.6% increase compared to the previous year. Visa's strong performance secured its place at the 147th position on the Fortune 500 list, which ranks the largest corporations in the United States based on revenue.

Market Capitalization and Stock Performance

Visa's shares showed strength in the financial markets, trading at over $143 per share. The company also boasts an impressive market capitalization of over $475.87 billion as of October 2023. This highlights Visa's significant presence in the financial world.

Position in the Fortune 500

Visa's financial success is further emphasized by its position in the Fortune 500. As of 2022, the company ranked 147th, showcasing its status as one of the largest corporations in the United States. This ranking is based on revenue and reflects Visa's continued growth and influence in the financial sector.

Investing in Generative AI

Visa has launched a $100 million generative AI (GenAI) ventures initiative to invest in emerging GenAI startups. These startups focus on payments, fintech, and commerce. The initiative is driven by Visa Ventures, the corporate investment arm of the global payments giant. Visa Ventures has been investing in and partnering with companies relevant to its industry since 2007.

Visa's involvement with AI technology dates back to 1993. The company aims to extend its leadership in AI to drive innovation in the payments industry. This will deliver value to its extensive network of partners and clients.

Generative AI is seen as one of the most transformative technologies of our time. It will reshape how we live and work, and it will also change commerce in ways we need to understand. Visa hopes to invest in some of the most innovative and disruptive venture-backed startups operating in generative AI, commerce, and payments.

Technological Innovations and Partnerships

Visa has been a pioneer in fintech, constantly pushing the boundaries of what's possible. Their technology has enabled seamless transactions and improved security for millions of users. Visa's collaboration with various fintech companies has allowed them to enhance their services and offer innovative solutions to their customers.

Visa actively collaborates with startups to bring new ideas to the market. These partnerships help Visa stay ahead in the competitive fintech landscape. For example, Visa's collaboration with Ramp has bolstered their services, making them more efficient and customer-friendly.

Visa's attempt to acquire Plaid was a significant move to expand their capabilities in the fintech space. Although the acquisition did not go through, it highlighted Visa's commitment to innovation and growth. This move was aimed at integrating Plaid's technology to offer more comprehensive services to their clients.

Visa's partnerships and technological advancements are not just about staying competitive; they are about connecting customers with what they want and need in a rapidly evolving market.

Visa's Global Reach and Network

Visa operates in more than 200 countries and territories, making it a truly global company. This extensive reach allows Visa to connect businesses, banks, and governments worldwide. Visa's network facilitates digital payments among a diverse set of consumers, merchants, financial institutions, and strategic partners.

Visa offers a wide range of products and services, including credit, debit, and prepaid cards. These products are available on various platforms such as cards, laptops, tablets, and mobile devices. Visa's services also cover fraud management, security, data products, and consulting.

Visa's network connects over 130 million merchant locations around the world. This global agreement follows Revolut and Visa's collaboration to offer card transfers powered by Visa Direct for peer-to-peer payments to ~90 countries in the world. Visa and Revolut team up to offer real-time cross-border payments for businesses, enabling instant transfers across 78 countries and 50 currencies.

Visa's mission is to uplift everyone, everywhere by being the best way to pay and be paid. This mission drives their efforts to remove barriers and connect more people to the global economy.

Conclusion

Visa's journey from a small credit card program to a global financial powerhouse is nothing short of remarkable. Starting with the first revolving credit card in 1958, Visa has continuously evolved, merging regional businesses and going public in one of the largest IPOs in history.

Today, Visa stands as a leader in digital payments, operating in over 200 countries and embracing new technologies like cryptocurrency and generative AI. Their commitment to innovation and inclusivity has not only transformed the way we make payments but also connected millions of people to the global economy.

To grow in regional and International markets, it is almost certain that founders and business owners need to understand the importance of bringing the company into the public market.

At PIF Capital, we fast-track investors, SMEs, and business owners with the power to earn higher profits through IPO (initial public offering).

Jonathan Por; our Founder and Chairman of PIF Capital is a serial entrepreneur with 30 years of experience. Throughout the years at PIF Capital, we have built an exclusive capital community with over 40,000 SME community members, and share formulas created by PIF Capital such as the CPTK(Capital, Professional, Talent, Keymanship) model, 3F(Friend, Family, Fans) model, and the ABC(A+ entrepreneur, Business model, Capital) model.

If you are interested in understanding more about how to make your business sexy, bankable, and destructive, then reach out to us at PIF Capital events page.

As Visa continues to push the boundaries of financial technology, its mission to simplify transactions and improve global connectivity remains as strong as ever. The future looks bright for Visa, as it continues to shape the world of finance and commerce.

Frequently Asked Questions

What is the history of Visa?

Visa started in 1958 when Bank of America introduced the first credit card, BankAmericard. It became Visa in 1976 and formed Visa Inc. in 2007. The company went public in 2008.

What was significant about Visa's IPO?

Visa's IPO in 2008 was the largest in U.S. history at the time. The company sold 446.6 million shares and raised $19.2 billion.

How does Visa integrate digital currencies?

Visa partnered with First Boulevard to allow users to buy, sell, and trade digital assets. They also accept the stablecoin USDC for transactions.

What was Visa's financial performance in 2022?

In 2022, Visa earned $14.96 billion with a revenue of $29.31 billion. They ranked 147th on the Fortune 500 list.

What is the GenAI Ventures Initiative?

Visa's GenAI Ventures Initiative is a $100 million investment in startups focused on generative AI, payments, fintech, and commerce.

In how many countries does Visa operate?

Visa operates in over 200 countries, offering various products and services to connect consumers and merchants globally.