Entrepreneurship is a key driver of any economy. Entrepreneurs bring new ideas to life, meet market needs, and take on risks with the hope of reaping rewards. To succeed, they must balance different types of capital, including managerial and entrepreneurial capital.

What many entrepreneurs understand of entrepreneurship is risk-taking through debt fundraising instead of other lucrative methods such as equity financing. A technique which leaders in the MNC use.

At PIF Capital, we help entrepreneurs understand the power of being a capital entrepreneur by educating them on the power of equity financing.

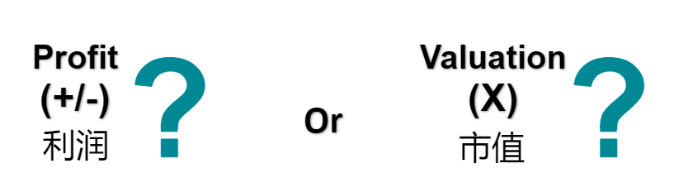

Focus on Multiple over Plus & Minus

Conventional entrepreneurs are always as they say ‘firefighting’. There’s always work to be done in the business and an entrepreneur must be a jack-of-all-trades. This means being a salesperson, a marketer, an accountant, and a business manager.

It’s tough.

Understanding the fundamentals of being a capital entrepreneur is widely known in Silicon Valley. This idea of raising capital before starting a business through equity financing is a reliable approach to continuously growing the business.

As a capital entrepreneur, the focus is on increasing valuation. By bringing in more investors into the business, it helps raise the company's valuation and understand the long-term growth of the company.

4 Reasons to Be a Capital Entrepreneur

Being a capital entrepreneur requires these 4 traits to get ahead of other SME business.

Use Equity to Attract Talent

Equity can be a powerful tool to attract and retain top talent. By offering equity as part of compensation packages, businesses can appeal to high-caliber professionals who are looking for more than just a paycheck. Equity provides employees with a sense of ownership and a direct stake in the company’s success, motivating them to contribute to the company’s growth and long-term goals.

Use Equity to Buy Company

Equity can be leveraged to acquire other companies, enabling strategic growth and expansion. By using equity as a currency in mergers and acquisitions, businesses can preserve cash flow while still achieving their growth objectives.

This approach can facilitate the integration of valuable assets, technologies, or market share from the acquired company, enhancing the overall value and competitive position of the business.

Use Equity to Raise Capital

Raising capital through equity financing is a common strategy for fueling business growth. By issuing shares to investors, companies can secure the funds needed to expand operations, invest in new projects, or enter new markets.

This method of raising capital can be more flexible than traditional debt financing, as it does not require regular interest payments and can align investor interests with the long-term success of the company.

Use Equity to Acquire Business Partner

Equity can be a valuable incentive when seeking to form strategic partnerships. By offering equity to potential business partners, companies can align interests and ensure a commitment to mutual success.

This approach can help secure collaborations with key partners, bringing in new expertise, resources, and opportunities that can drive the business forward. Partnerships formed through equity arrangements often result in stronger, more synergistic relationships that benefit all parties involved.

Power of Capital Entrepreneurship

By understanding how capital entrepreneurship work, business owners are already one step ahead of the curve. If you're still a business owner that's owning 100% of the business, it's time to look inwards to realize the work would significantly easier if you are able to raise management team and provide equity in the business to incentives them to work harder.