Apple is the company that most young Gen-Z know for their iPhones, Millennials remember them for their I-pods, and legends remember them for their invention of the Macintosh.

With it launch of the iPhone in June 2007, it became the most valuable company from USD 4.39 per share in January 2008 to USD 14.40 in December 2011, tripling its value in just 4 years.

Despite being the most valuable company, Apple continued to raise more than USD 1.2 billion from investors from 2011 to 2024. A smart financial strategy that may leave investors bewildered.

Why Raise More Capital Despite Being a Cash Cow?

Based on Apple's financial statement as of February 3, 2023, long-term debt is at $91.831 billion and current debt is at $16.569 billion, amounting to $108.4 billion in total debt.

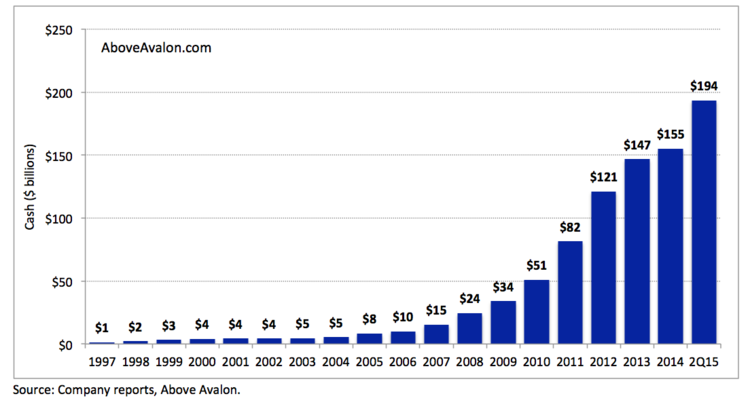

With USD 194 billion in cash on hand, Apple realistically doesn’t require to take on additional debt to fund future enterprises. However, there are 7 key reasons why taking on more equity financing is a smart financial move:

1. 0% Effective Interest Rate

Apple can access capital at extremely low interest rates; in fact, the company’s effective interest rate is 0%. These are the perks of having large equity set aside to leverage equity financing!

With 0% interest rate on debt, Apple can reward its customers with 0% interest on the latest iPhone product. This marketing strategy rewards new Apple users to jump on Apple's more affordable purchasing plans.

By borrowing money, they can effectively reduce their overall cost of capital, optimize their financial structure, and continue to innovate.

2. Keeping Uncle Sam at Bay

Historically, much of Apple's cash reserves(94%) have been held overseas. Repatriating this cash to the United States would incur significant tax liabilities.

Apple is located in over 528 locations in 26 different countries all around the world. To avoid paying high taxes, the company raises capital to fund its domestic operations and shareholder returns without triggering these tax costs.

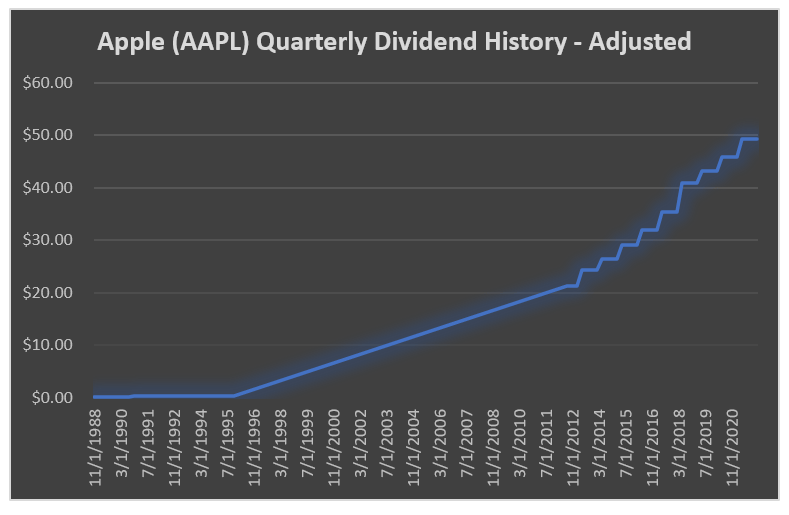

3. Share Buybacks and Dividends, Thus Attracting More Investors

One of the best financial marketing strategies Apple CEO Tim Cook has done is attracting investors for over a decade through share buyback and increasing dividends. Since 2012, Apple has been giving out more dividend to their investor as a positive sign to reward their trust in the brand.

From August 2012 through March 2014, Apple spent $66 billion in cash on its capital return program. And despite the company's negative net growth in 2024, it launches yet another $110 billion buyback program.

Raising capital through equity financing allows Apple to return cash to shareholders via share buybacks and dividends without depleting their on-hand cash. This can support their stock price and provide returns to shareholders.

4. More Capital to Breath Better

Having access to a mix of debt and cash gives Apple greater flexibility to make large investments, such as R&D, acquisitions, or new product launches, without having to wait for cash flow to build up.

Since 99% of businesses fail within the first 5 years of the business due to capital. As capital entrepreneurs, the goal of the business is raising capital without having to worry about capital itself.

5. Balance Sheet Optimization

Maintaining a certain level of good/bad debt on the balance sheet can be part of a strategy to optimize the company’s capital structure. Investors understand that taking on debt to invest in futuristic R&D could spark huge growth in the business and therefore are more incentives to invest for the future.

That being said, the job of a CFO is to handle debt levels effectively to enhance returns on equity and maintain an efficient balance sheet. In the words of Apple’s CFO(Chief Financial Officer) Luca Maestri: “Apple’s balance sheet is golden and delicious!”

6. Economic Conditions

In times of favorable economic conditions and low interest rates, it makes financial sense to borrow money. This is especially true when the borrowed funds can be invested in high-return projects.

After the launch of the iPhone, Apple continued to invest heavily in R&D. Using the 1.2 billion in debt, the company created many other products such as the Macbook, iPad, Iwatch, and its latest product Apple Vision.

This stirs investors' interest knowing that Apple has a strong reputable standard in getting high-quality products up and running in the market.

7. Risk Management

Holding a mix of debt and cash allows Apple to manage financial risk more effectively. By having debt, Apple can effectively hedge against inflation which is now at 3.36% as of May 2024, as the value of its fixed-rate debt would diminish in real terms as inflation remains sticky over the next few years.

Why Apple Remains The Most Valuable Company

Apple has remained the most valuable company in the world for over 10 years because of effective debt management and understanding of raising capital through the public market. With it, the corporation can steadily:

- Attract talent

- Invest heavily into R&D

- Expand its market

To grow in regional and International markets, it is almost certain that founders and business owners need to understand the importance of bringing the company into the public market.

At PIF Capital, we fast-track investors, SMEs, and business owners with the power to earn higher profits through IPO (initial public offering).

Jonathan Por; our Founder and Chairman of PIF Capital is a serial entrepreneur with 30 years of experience. Throughout the years at PIF Capital, we have built an exclusive capital community with over 40,000 SME community members, and share formulas created by PIF Capital such as the CPTK(Capital, Professional, Talent, Keymanship) model, 3F(Friend, Family, Fans) model, and the ABC(A+ entrepreneur, Business model, Capital) model.

If you are interested in understanding more about how to make your business sexy, bankable, and destructive, then reach out to us at PIF Capital events page.